Global Rubber Processing Chemicals Market: Trends, Opportunities, and Future Outlook

Tejask Kam

29 Aug, 2025

10 mins read

3

Tejask Kam

29 Aug, 2025

10 mins read

3

Introduction

Rubber processing chemicals are indispensable additives used in the production and modification of natural and synthetic rubber. These chemicals enhance the performance, durability, strength, and resistance of rubber products, making them vital in industries ranging from automotive and construction to aerospace and consumer goods. They include accelerators, plasticizers, anti-degradants, processing aids, and blowing agents, all of which play a critical role in ensuring that rubber materials can withstand environmental stress, mechanical pressure, and chemical exposure.

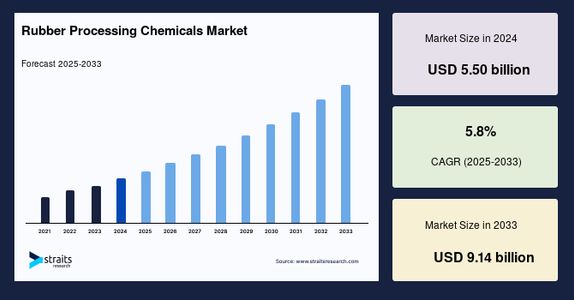

The global rubber processing chemicals market size was valued at USD 5.50 billion in 2024 and is projected to grow from USD 5.82 billion in 2025 to USD 9.14 billion by 2033, exhibiting a CAGR of 5.8% during the forecast period (2025-2033).

Market Dynamics

Key Growth Drivers

- Automotive Industry Expansion

- The automotive industry remains the largest consumer of rubber processing chemicals, primarily for tire manufacturing. Growing vehicle production and rising demand for high-performance tires with better grip, wear resistance, and fuel efficiency are major growth factors.

- Booming Construction Sector

- Rubber processing chemicals are essential in the production of roofing materials, flooring, sealants, and adhesives. The global construction boom, particularly in emerging economies, is significantly boosting demand.

- Increased Use of Synthetic Rubber

- Synthetic rubber, which offers enhanced durability and resistance, requires more chemical additives than natural rubber. Its widespread adoption across industries is propelling chemical consumption.

- Rising Demand for Green and Sustainable Solutions

- Environmental concerns and strict regulations are driving the development of eco-friendly rubber processing chemicals with lower toxic content and reduced carbon footprint.

Market Challenges

- Environmental and Health Concerns

- Many traditional rubber processing chemicals, such as nitrosamines and certain accelerators, have been linked to environmental pollution and health hazards, prompting stringent regulatory measures.

- Raw Material Price Volatility

- Prices of petrochemical-based raw materials used in rubber chemicals fluctuate significantly, affecting overall production costs.

- Shift Toward Electric Vehicles (EVs)

- While EV adoption supports demand for specialized tires, it could reduce the overall number of automotive components made from rubber, slightly altering the demand pattern for processing chemicals.

Market Segmentation

By Product Type

- Anti-degradants – Protect rubber from aging, heat, oxygen, and ozone damage. They dominate the market as durability remains a top priority.

- Accelerators – Speed up vulcanization, improving efficiency and performance.

- Plasticizers – Increase flexibility, softness, and workability of rubber.

- Processing Aids – Improve mixing, extrusion, and molding processes.

- Blowing Agents & Others – Used in foamed rubber products for lightweight applications.

By Application

- Tires – The largest application segment, accounting for over 70% of demand. Growth in tire production, especially in Asia-Pacific, ensures strong market momentum.

- Non-Tire Applications – Includes hoses, belts, footwear, industrial goods, adhesives, and medical devices. Growing industrialization and urbanization are supporting expansion here.

By End-Use Industry

- Automotive – Dominates the market due to the huge demand for tires and rubber-based automotive parts.

- Construction – Rapid urban development drives demand for sealants, adhesives, and roofing materials.

- Industrial & Manufacturing – Rubber processing chemicals are essential in conveyor belts, gaskets, and protective gear.

- Consumer Goods – Footwear and household products also contribute significantly.

Regional Insights

Asia-Pacific

- The largest and fastest-growing regional market, led by China, India, and Japan.

- Rapid vehicle production, large-scale tire manufacturing, and robust construction activities drive growth.

- China is home to some of the world’s biggest tire producers, making it the epicenter of demand.

Europe

- Strong regulatory framework emphasizing sustainable and low-toxicity chemicals.

- Growing EV industry and investments in green materials drive innovation.

North America

- A mature market, with demand driven by replacement tires and technological innovations in rubber compounds.

- The U.S. remains a significant hub for R&D in sustainable chemical formulations.

Latin America

- Emerging growth opportunities in Brazil and Mexico, fueled by rising vehicle ownership and infrastructure development.

Middle East & Africa

- Increasing adoption of rubber chemicals in industrial and construction sectors.

- South Africa remains the key market, while Gulf nations show potential in automotive aftermarket expansion.

Competitive Landscape

The rubber processing chemicals market is highly competitive, with players focusing on R&D, capacity expansions, and sustainability initiatives. Key companies include:

- Lanxess AG – A leader in specialty chemicals, with strong focus on accelerators and anti-degradants.

- Eastman Chemical Company – Known for innovative, sustainable solutions in rubber additives.

- Solvay S.A. – Invests heavily in eco-friendly chemicals for tire manufacturing.

- Sunsine Chemical – A major supplier in Asia with strong presence in accelerators.

- Akrochem Corporation – Focuses on specialty chemicals tailored for performance applications.

Emerging players are also focusing on localized production to cut costs and meet regional demand. Strategic collaborations between tire manufacturers and chemical producers are common to ensure consistent supply and innovation.

Industry Trends and Innovations

- Eco-Friendly Chemicals

- The push toward sustainability is fueling the development of non-toxic, biodegradable rubber additives.

- Smart Tire Development

- As connected and smart vehicles rise, demand for specialty rubber chemicals used in high-tech tires is increasing.

- Nanotechnology

- Nano-fillers and nanocomposites are being used to enhance durability, flexibility, and performance of rubber products.

- Circular Economy Initiatives

- Recycling and reusing rubber materials are encouraging the creation of chemicals that improve reprocessing efficiency.

Market Outlook

The future of the rubber processing chemicals market is closely tied to the growth of the automotive and construction sectors. With the ongoing electrification of vehicles, demand for high-performance tires, and strict environmental regulations, the industry is poised for transformation.

- Short Term (2024–2026): Growth driven by rising tire production and recovery in construction activity post-pandemic.

- Medium Term (2027–2030): Strong push for sustainable chemicals as regulations tighten globally.

- Long Term (2031–2033): Innovation in green technologies and circular economy practices will redefine competitive positioning in the market.

Conclusion

The global rubber processing chemicals market is on a solid growth trajectory, underpinned by rising automotive production, expanding construction activity, and the increasing adoption of synthetic rubber. Although regulatory hurdles and environmental concerns pose challenges, innovation in eco-friendly solutions, nanotechnology, and sustainable practices is paving the way for long-term expansion.

As industries demand stronger, safer, and more sustainable rubber products, the market for rubber processing chemicals will continue to evolve, playing a critical role in shaping the future of mobility, construction, and consumer goods.

Written By:

Tejask Kam

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.