Know Bajaj Finance Gold Loan Interest Rate Eligibility and Features

Puja Rawat

28 Jul, 2025

7 mins read

15

Puja Rawat

28 Jul, 2025

7 mins read

15

When you urgently need cash, your gold jewellery can be a smart solution. A Bajaj Finance Gold Loan lets you unlock the true value of your gold without selling it, offering quick approval at attractive Bajaj Finance Gold Loan Interest Rates starting from just 9.50% per year. With minimal paperwork and flexible repayment terms, this loan is ideal for sudden expenses, business growth, or family needs. Knowing key features and eligibility ensures you secure the best possible deal, letting your gold effectively support your financial goals.

Interest Rates on Bajaj Finance Gold Loan

When borrowing against gold, understanding interest rates helps you save money. Bajaj Finance Gold Loan Interest Rates start at just 9.50% per year, lower than personal loans or credit cards since your gold acts as security. The exact rate depends on the gold’s purity (18–22 karat), the loan amount, and tenure, with higher amounts and shorter durations usually attracting better rates.

Here are the key points clearly explained:

- Interest Rates: Rates start from 9.50% per year, making repayments affordable and budget-friendly

- Processing Fee: A small fee of 0.15% of the loan, between ₹99 (minimum) and ₹600 (maximum), applies to your Bajaj Finance Gold Loan

- No Hidden Charges: Bajaj Finance clearly mentions all fees upfront, ensuring you avoid unexpected costs or surprises

- Foreclosure & Prepayment: You can repay your loan partially or fully at any time without extra charges, helping you reduce interest payments

- Penal Interest: A penalty interest rate of 3% per year applies if your repayment is overdue, so timely payments are essential

Eligibility Criteria for Bajaj Finance Gold Loan

Here are the simple conditions you must meet for a hassle-free Bajaj Finance Gold Loan approval:

- Nationality: You must be an Indian citizen

- Age: Your age should be between 21 and 70 years

- Gold Purity: Jewellery must have purity between 18 and 22 karats

- Gold Type: Only gold jewellery is accepted; coins or bars are not allowed

- Credit Score & Income Proof: Not needed, as the loan is secured against your gold

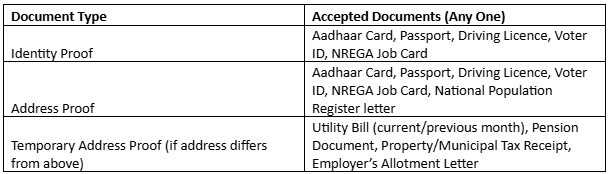

Documents Required for Bajaj Finance Gold Loan

Here are the documents clearly listed for easy reference when applying for a Bajaj Finance Gold Loan on Bajaj Markets:

Why Choose Bajaj Finance Gold Loan – Key Features and Benefits

Here are key features that make the Bajaj Finance Gold Loan a smart choice for meeting your financial needs:

Higher Loan Amount

You can borrow a generous loan amount of up to ₹2 Crores to comfortably manage your personal or business expenses.

Competitive Interest Rates

Benefit from affordable repayments with attractive Bajaj Finance Gold Loan Interest Rates starting as low as 9.50% per annum.

Flexible Repayment Options

Choose repayment schedules that suit your financial comfort, such as monthly, quarterly, half-yearly, annually, or even partial repayments.

No Prepayment or Foreclosure Charges

Repay your Bajaj Finance Gold Loan early without extra charges, allowing you to reduce your total interest cost.

Easy Gold Withdrawal

Conveniently retrieve part of your pledged gold jewellery by repaying an amount equal to its market value.

How to Apply for a Bajaj Finance Gold Loan?

Here is a clear and simple way to apply for your Bajaj Finance Gold Loan online in just a few minutes:

- Visit Bajaj Markets or download the Bajaj Markets App

- Click on ‘CHECK ELIGIBILITY’ to start your application

- Select ‘New Gold Loan’ as the type of loan

- Fill in basic details like name, mobile number, and birth date

- Enter the loan amount needed along with your pincode

- Provide your gender and email address accurately

- Submit the application by clicking ‘SUBMIT’

- Wait for a representative to contact you for gold valuation

Conclusion

A Bajaj Finance Gold Loan is an ideal solution when you need quick funds at competitive interest rates. Transparent fees, simple eligibility criteria, flexible repayments, and secure gold storage ensure a stress-free borrowing experience. By clearly understanding the attractive Bajaj Finance Gold Loan Interest Rate and its beneficial features, you can confidently turn your gold into a powerful financial asset. Whether facing urgent expenses or investing in opportunities, choose wisely and let your gold jewellery support your financial future today.

Written By:

Puja Rawat

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.