Understanding ZATCA Phase 2: Key Requirements and Compliance

Aya Basha

20 Mar, 2025

9 mins read

28

Aya Basha

20 Mar, 2025

9 mins read

28

The (Zakat, Tax and Customs Authority) ZATCA Phase 2 essentially represents a major step in Saudi Arabia towards the digital transformation of tax compliance. With the successful implementation of ZATCA Phase 1, the second phase adds on a higher level of requirements towards e-invoicing for transparency, accuracy, and efficiency in business transactions. In this phase, the businesses are required to connect their e-invoicing systems to ZATCA's central platform, making real-time invoice validations and reporting possible. Thus, companies operating in Saudi Arabia must upgrade their invoicing systems to align with this provision in order to avert penalties.

In ZATCA Phase 2, businesses must meet strict requirements on e-invoice generation, digital signatures, and clearance of invoices before presenting them to customers. This shift eliminates tax fraud, promotes efficiency, and thereby enhances the economic situation of Saudi Arabia. An understanding of the core ZATCA Phase 2 requirements is a must for any business wanting to stay compliant and smooth any transition into the new system. This guide will inform you of the primary compliance requirements, those to whom they will apply, and how companies should prepare for the new phase.

Here is some of the understanding of ZATCA Phase 2: Key Requirements and Compliance

Probably Important Requirements of ZATCA Phase 2

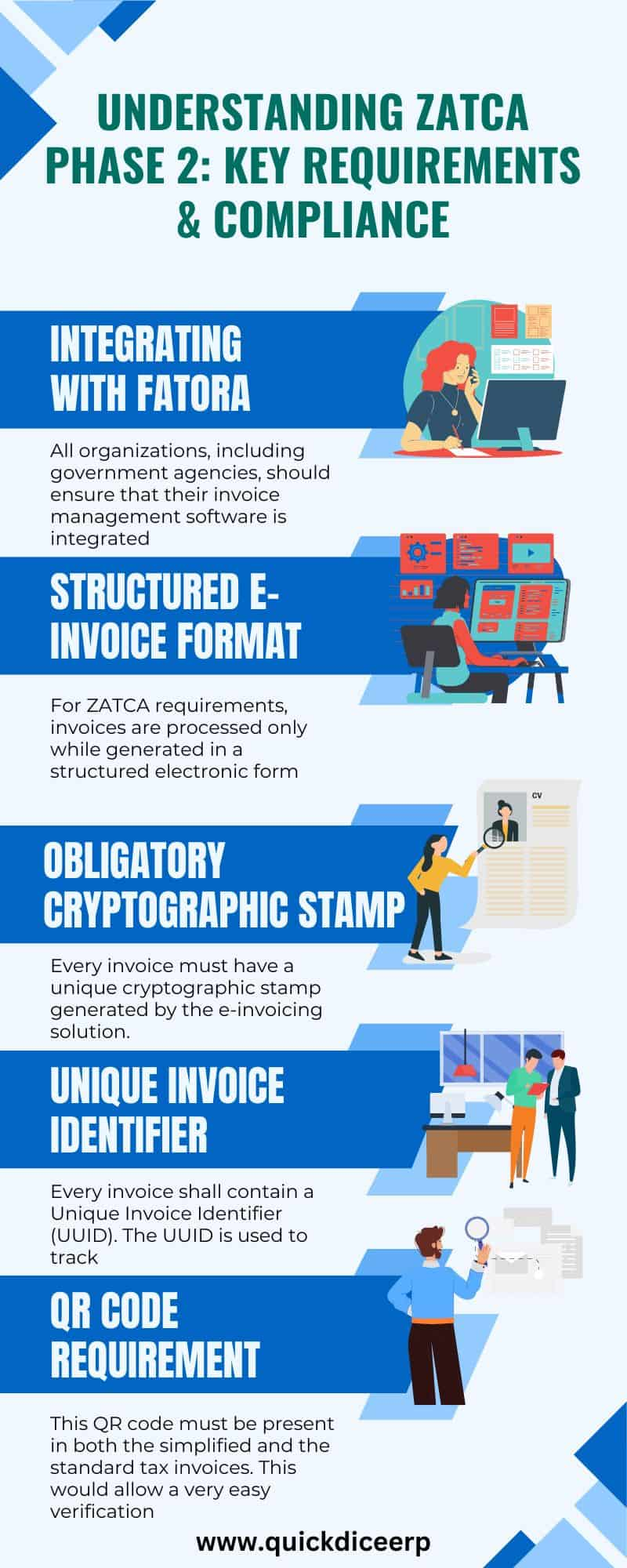

1. Integrating with FATORA

All organizations, including government agencies, should ensure that their invoice management software is integrated with ZATCA's Fatora system so that real-time data sharing is executed for it. This system will have an invoice validation mechanism against all regulatory requirements before it can be managed to buyers.

2. Structured E-invoice Format

For ZATCA requirements, invoices are processed only while generated in a structured electronic form like an XML or PDF/A-3 (with embedded XML). This simplifies processing and verification.

3. Obligatory Cryptographic Stamp

Every invoice must have a unique cryptographic stamp generated by the e-invoicing solution. Hence, this specific identifier authenticates the invoice and hinders any tampering options.

4. Unique Invoice Identifier (UUID)

Every invoice shall contain a Unique Invoice Identifier (UUID). The UUID is used to track and validate the transactions. It is different from the invoice number assigned by the business.

5. QR Code Requirement

This QR code must be present in both the simplified and the standard tax invoices. This would allow a very easy verification process for ZATCA, as well as for the recipients.

6. Electronic Signature

All invoices should be digitally signed, which would ensure integrity of data as well as authenticity of the sender. This is the most important compliance requirement in ZATCA law.

7. Real-Time Data Broadcasting to ZATCA

Invoices are to be made available to ZATCA's FATOORA system, either in real-time or near real-time, which allows every invoice to be made compliant with the standards before delivery to the customer.

8. Archiving and Data Storage Compliance

Under ZATCA guidelines, businesses must keep their e-invoices in secure, tamper-proof electronic archives for six years, at a minimum.

Guidelines for Compliance by Businesses

1. Upgrade E-Invoicing Systems

Businesses must use an e-invoicing software solution that meets ZATCA's technical and security requirements. Many ERP systems, such as QuickDice ERP, can seamlessly integrate for compliance.

2. Get ZATCA Clearance

Businesses need to examine and confirm if their invoicing system is duly cleared and compliant with ZATCA rules before invoices are issued. New integrations may thus be subject to testing and certification.

3. Ensure Compliance from Suppliers

Suppliers and vendors need to comply with ZATCA Phase 2 requirements too. Businesses need to work closely with their vendors in ensuring it is compatible with the e-invoicing system.

4. Continuous System Upgrade

ZATCA might carry out regular administrative updates on the regulations, and businesses should stay abreast of the developments and effect these changes to their e-invoicing solutions.

5. Employee Training on Compliance

Training should be imparted to the employees dealing with invoicing and finance on ZATCA Phase 2 regulations to ensure less disruption in operations and very few compliance errors.

Impact on Businesses

1. Better Compliance and Fewer Errors

With built checks on formats and validation in real-time, the errors in invoice processing get minimized, allowing businesses to remain compliant without incurring penalties.

2. Accelerated Processing of Invoices

Working hand-in-hand with FATOORA provides a fast-track mode for invoice validation, bringing in cash flow faster with other benefits.

3. Reduced Chance of Fraud

The cryptographic protection and digital signatures render these invoices immovable and unforgeable, which, in turn, minimizes the risk of fraud.

4. Rapid Tax Audit

Digital storage minimizes the paperwork and reduces the tax audit process time by making e-invoicing simple.

5. Increased Efficiency

With automated invoicing and compliance checks, businesses can concentrate on other operational aspects rather than manual invoicing functions.

Conclusion

As e-taxation progresses in Saudi Arabia, it is ZATCA Phase 2, which stands in the middle, modernizing e-invoicing and compliance. Companies that adapt early will reap the rewards of enhanced operating efficiency, minimized tax errors, and greater financial transparency. Non-compliance with ZATCA requirements may attract hefty penalties; hence, timely upgrade of the invoicing systems is extremely crucial. Implementation of ZATCA-approved e-invoicing software will prevent any disruption and ensure smooth tax operation.

To sum up, ZATCA Phase 2 is not just a regulatory compliance but an opportunity for financial process modernization. By adopting digital invoicing solutions in full compliance, businesses can increase their competitiveness, thus advancing the Saudi vision for a fully digital and tax-transparent economy.

window.NREUM||(NREUM={});NREUM.info={"beacon":"bam.nr-data.net","licenseKey":"NRJS-3109bb2e2783f515265","applicationID":"558315209","transactionName":"blUHbEVQCxECBUVQWVcfMEpeHhARBhRCFlRVXwIXVEMAAxcDU1VZXh4VUEc=","queueTime":0,"applicationTime":129,"atts":"QhIEGg1KGB8=","errorBeacon":"bam.nr-data.net","agent":""}

Written By:

Aya Basha

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.