Temperature Sensor Market Report Size, Share, Trends & Growth

Amo Shekhar

03 Sep, 2025

10 mins read

25

Amo Shekhar

03 Sep, 2025

10 mins read

25

Temperature sensors, spanning thermocouples, RTDs, thermistors, infrared (IR), and integrated IC sensors, are critical building blocks across industrial automation, automotive & EVs, consumer electronics, healthcare devices, energy management, and smart buildings. The market’s momentum comes from three converging forces:

- pervasive sensing in IoT/IIoT and edge computing,

- tighter safety, quality, and energy-efficiency regulations, and

- the electrification/digitization of vehicles and factories.

In parallel, miniaturization and CMOS integration are unlocking new form factors (e.g., tiny IC sensors for wearables) while advanced packaging and materials (SiC, GaN ecosystems in power electronics) demand precise thermal monitoring. Software is becoming a differentiator as vendors pair sensors with calibration, diagnostics, and analytics to reduce drift and maintenance.

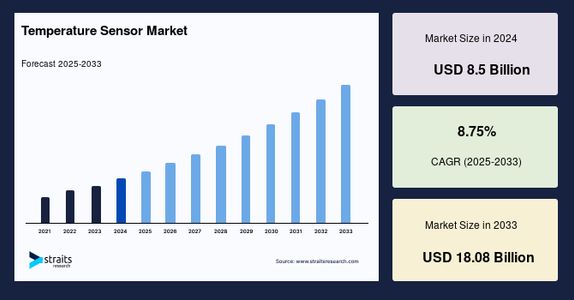

The global temperature sensor market size was valued at USD 8.5 billion in 2024 and is projected to grow from USD 9.24 billion in 2025 to reach USD 18.08 billion by 2033, growing at a CAGR of 8.75% during the forecast period (2025-2033).

Request a Sample Report@ https://straitsresearch.com/report/temperature-sensor-market/request-sample

Restraints

- Price pressure & commoditization: Thermistors and basic IC sensors face intense competition, squeezing margins and encouraging bundling with value-add software or modules.

- Accuracy vs. cost trade-offs: High-precision RTDs/thermocouples increase BOM and require careful signal conditioning and calibration.

- Harsh-environment reliability: Elevated temperatures, vibration, chemical exposure, and electromagnetic interference complicate design and lifetime assurance.

- Supply-chain volatility: Specialty materials, ASIC availability, and packaging constraints can delay programs in automotive and industrial sectors.

Opportunities

- EVs & battery safety: Cell-level thermal monitoring, BMS integration, and predictive analytics for pack safety/aging.

- Digital factories: Condition monitoring, predictive maintenance, and thermal profiling for yield and uptime in process/ discrete manufacturing.

- Healthcare & wearables: Continuous body-temperature and skin-surface sensing, remote patient monitoring, and smart patches.

- Smart buildings & energy: HVAC optimization, zone-level comfort, and grid-interactive efficient buildings; decarbonization drives more sensing points.

- Edge AI & self-calibration: On-sensor diagnostics, fault detection, and cloud/edge analytics reduce maintenance costs and improve accuracy over life.

Segments in Short (XYZ)

X , By Type: Thermocouples | RTDs | Thermistors | IC/CMOS Temperature Sensors | Infrared (Contactless) | Fiber-Optic & Niche

Y , By End Use: Industrial & Process | Automotive/EV | Consumer Electronics | Healthcare/Medical | Aerospace & Defense | Energy & Utilities | Building Automation

Z , By Interface/Form Factor: Analog | Digital (I²C/SPI/1-Wire) | Wireless Modules | Embedded/SoC | Probe/Surface/Plug-in

Key Players (AB) with Revenue Context

(Figures below are approximate total company revenues from recent fiscal years; temperature sensors form a subset.)

- Texas Instruments (TI): ~US$17–20B total revenue range in recent years; broad analog/embedded portfolio includes IC temp sensors heavily used in consumer, industrial, and automotive.

- Analog Devices (ADI): ~US$12–13B; strong in precision sensing and signal chains; integrated temperature solutions for industrial/medical.

- STMicroelectronics (ST): ~US$16–18B; mixed-signal ICs and MEMS presence; temp sensors in consumer/industrial.

- Infineon Technologies: ~€15–17B; automotive & power/industrial leadership with thermal sensing in safety/management.

- TE Connectivity: ~US$15–17B; broad sensor division (including thermistors/RTDs) serving industrial, medical, and transport.

- Honeywell: ~US$35–38B; industrial-grade sensors/solutions including high-reliability temperature probes and assemblies.

- Sensata Technologies: ~US$3–4B; strong in transport/industrial sensing with rugged temp solutions.

- Omron: ~US$5–7B equivalent; factory automation and devices including temperature controllers/sensors.

- Vishay, NXP, Renesas, Microchip, Panasonic, Emerson, Siemens also participate across niches from discrete components to system-level solutions.

Note: Vendor revenue attributable specifically to temperature sensors is a subset of totals and varies by segment mix.

Latest Developments & Collaborations

- Automotive thermal management: Partnerships between semiconductor vendors and Tier-1s for EV battery pack monitoring, onboard chargers, and motor-inverter thermal safety (ASIL compliance, functional safety diagnostics).

- IIoT & cloud ecosystems: Joint solutions bundle sensors, gateways, and dashboards for predictive maintenance (e.g., vibration + temperature + current sensing fused for anomaly detection).

- Wearables & medical devices: Collaborations with device OEMs to embed low-power IC temperature sensors and calibrated skin-contact probes meeting medical safety/biocompatibility standards.

- Smart buildings: Integrated offerings with BMS platforms enabling room/duct, heat pump, and heat-exchanger optimization for energy savings.

- Packaging & calibration services: Co-development with contract manufacturers to deliver pre-calibrated sensor modules, reducing OEM time-to-market.

Purchase the Full Report@ https://straitsresearch.com/buy-now/temperature-sensor-market

FAQs

Q1. Which temperature sensor type is most widely used?

For general-purpose electronics, IC/digital temperature sensors (I²C/SPI) are common due to low cost and easy integration. For high precision and stability, RTDs dominate; for wide temperature ranges and ruggedness, thermocouples are preferred. IR sensors win where non-contact is essential.

Q2. What’s driving demand in automotive?

EV battery thermal management, inverter/motor protection, cabin comfort, and ADAS/compute thermal control, plus tighter safety standards, are increasing sensor counts per vehicle.

Q3. How important is calibration?

Very. Calibration (factory or in-field) minimizes drift, ensures accuracy across temperatures, and reduces false alarms. Vendors increasingly offer self-diagnostics and digital trimming to extend calibration intervals.

Q4. Is cybersecurity relevant to temperature sensors?

Yes, when sensors connect via gateways or are addressed digitally. Secure boot, encrypted comms, and authenticated updates matter in IIoT and automotive contexts.

Q5. What trends should buyers watch?

- More combo sensors (temp + humidity/pressure).

- Edge analytics for anomaly detection.

- Miniaturized, ultra-low-power sensors for wearables.

- Functional safety features and diagnostics in automotive/industrial designs.

Conclusion

The temperature sensor market is transitioning from commodity components to solution-centric offerings that fuse precision hardware, smart calibration, and analytics. Growth vectors include EVs, digital factories, health tech, and smart buildings, each adding more sensing points and demanding higher reliability. Vendors that pair accurate, rugged sensors with software, reference designs, and strong ecosystem partnerships are best positioned to capture value while navigating pricing pressure and supply variability.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Written By:

Amo Shekhar

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.