Top Family Business Advisors in India (2025): Benefits, Role & How to Choose the Right One

Priyanshu Sain

23 May, 2025

10 mins read

14

Priyanshu Sain

23 May, 2025

10 mins read

14

Introduction

Family businesses are the backbone of India's economy, contributing over 70% to the GDP. Yet, nearly 85% of family-run businesses don't make it past the third generation. Why? Lack of succession planning, internal conflict, and emotional decision-making.

Enter the Family Business Advisor a mentor, strategist, and neutral voice who helps families navigate complexity, preserve harmony, and build legacies.

In this article, we'll explore who these advisors are, why they matter more than ever in 2025, and how you can choose the right one for your family.

Why You Need a Family Business Advisor in India

- Intergenerational Wealth Transfer: India is set to witness one of the largest intergenerational wealth transfers globally. An advisor ensures it's smooth.

- Succession Planning: Prevent conflict over leadership and ownership.

- Governance: Create systems to separate family and business issues.

- Conflict Resolution: A neutral voice can prevent legal and emotional disasters.

- Family Vision Alignment: Keep the family aligned with long-term goals, not just profit.

Traits of the Best Family Business Advisors

- Emotional Intelligence: They understand people, not just numbers.

- Neutrality: No personal stake, only objective advice.

- Cross-functional Knowledge: Legal, finance, psychology, business strategy.

- Cultural Sensitivity: Especially important in Indian joint families.

- Confidentiality & Trust: They become part of your inner circle.

Top Family Business Advisors in India (2025 Edition)

1. Rahul Malodia: Business Coach & Family Business Advisor

Rahul Malodia is one of the most sought-after business coaches in India, especially known for his expertise in guiding MSMEs and family-run enterprises. With a background in chartered accountancy and business consulting, Rahul brings a unique combination of financial acumen and strategic foresight.

He conducts extensive business diagnostics to understand the current pain points of family businesses and then provides clear, actionable solutions through structured frameworks. His sessions focus on areas like revenue scaling, intergenerational alignment, employee accountability, and leadership transition.

What sets him apart is his deep understanding of Indian cultural values and how they impact decision-making in family-run businesses. His programs are practical, example-driven, and tailored to the Indian context.

2. Laxmi Narain: IFBN Consultants

Laxmi Narain is the founder and principal advisor at IFBN Consultants, a firm that has become synonymous with professionalizing India's family-run enterprises. With experience spanning more than 750 Indian business families, his expertise lies in resolving deep-rooted family conflicts and preparing businesses for smooth intergenerational transitions.

He adopts a holistic advisory model that includes conducting legacy alignment sessions, succession readiness assessments, and establishing legally sound governance frameworks like family constitutions and dispute mediation protocols. Laxmi's approach is empathetic, culturally rooted, and process-driven, making him one of the most respected voices in India's family business ecosystem.

His goal is not just to grow businesses, but to preserve families behind them, ensuring continuity, harmony, and a shared vision across generations.

3. Ram Charan: Global Thought Leader

Ram Charan is an internationally renowned business advisor with Indian roots. He has worked with Fortune 500 companies and leading Indian family businesses. His core expertise includes leadership development, succession planning, and scaling businesses globally.

Charan brings a highly intellectual yet practical approach and is known for simplifying complex business issues into clear, actionable strategies. His influence spans across generations of family-owned conglomerates.

4. Dr. Shailesh Thaker, “ CEO, Coach & Family Facilitator

Dr. Thaker is widely respected for his work on organizational behavior and personal development in family enterprises. He helps family businesses navigate emotional conflicts, transition planning, and leadership training.

His approach blends psychological insight with management science, making him a preferred advisor for families going through generational shifts.

5. Siddharth Zarabi: Strategic Family Business Coach

Siddharth specializes in resolving long-standing disputes and restructuring family businesses post-pandemic. He is known for his work in the MSME sector, where leadership succession and trust issues are most prevalent.

He uses a combination of coaching, facilitation, and structured documentation to bring clarity and continuity in business roles.

How to Choose the Right Advisor for Your Family

Ask yourself:

- Have they handled businesses like ours?

- Do they offer customized solutions?

- Are they willing to talk to every stakeholder?

- Can they speak both numbers and emotions?

Conclusion

Choosing a family business advisor is not about hiring a consultant it's about inviting someone into your family's legacy. Pick someone who understands not just business growth, but emotional dynamics and long-term harmony.

In 2025, as Indian families grow wealthier and more complex, the demand for thoughtful, emotionally intelligent, and strategic family advisors is only going to rise.

Frequently Asked Questions (FAQs)

Q1. What exactly does a family business advisor do?

A family business advisor helps families manage their business and relationships more effectively. Their role includes succession planning, resolving family disputes, creating governance structures, and aligning personal and business goals.

Q2. How is a family business advisor different from a financial advisor?

While a financial advisor focuses primarily on investments, insurance, and wealth management, a family business advisor addresses organizational dynamics, leadership transitions, and interpersonal conflicts within the family.

Q3. When should a family hire a business advisor?

Ideally, families should bring in an advisor during times of transition, such as handing over control to the next generation, expanding rapidly, or experiencing internal disagreements. Early involvement can prevent major breakdowns

Q4. How do I know if the advisor is the right fit?

Look for someone who understands your family culture, has experience with businesses like yours, and is emotionally intelligent. A trial session or initial consultation can help gauge compatibility.

Q5. Are family business advisors only for large businesses?

Not at all. Even small and mid-sized enterprises benefit greatly from structured succession planning and family governance. MSMEs face the most risk without proper advisory support.

Written By:

Priyanshu Sain

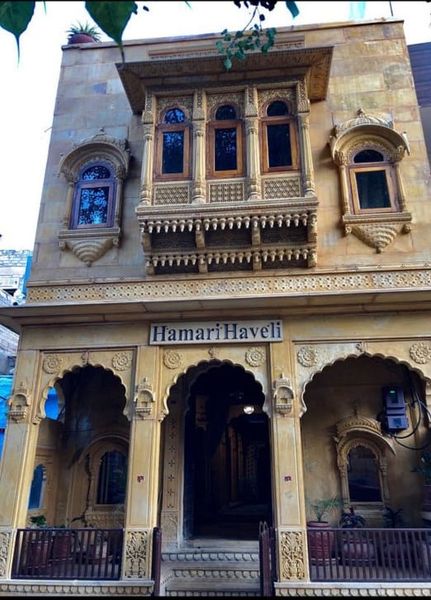

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.