How to Calculate EPS: A Simple Guide for Investors

Sophia Robinson

14 Feb, 2025

8 mins read

98

Sophia Robinson

14 Feb, 2025

8 mins read

98

Understanding the financial health of a company is crucial for investors. One of the key metrics used to gauge a company's profitability is the Earnings Per Share (EPS). EPS serves as an indicator of a company's earnings allocated to each outstanding share of common stock, making it a vital piece of information for making informed investment decisions.

This article provides a detailed guide on how to calculate EPS, with a focus on the primary keyword 'EPS calculation' and secondary keyword 'diluted earnings per share'.

What is EPS?

EPS, or Earnings Per Share, measures a company's profit divided by the outstanding shares of its common stock. In simpler terms, it indicates how much money a company makes for each share held by investors. Companies with higher EPS are often considered more profitable and appealing to investors.

EPS Calculation

The basic formula for EPS calculation is:

\[ \text{EPS} = \frac{\text{Net Income} - \text{Preferred Dividends}}{\text{Weighted Average Shares Outstanding}} \]

1. Net Income: This is the total profit of a company after taxes and all expenses have been deducted.

2. Preferred Dividends: These are the dividends that must be paid to preferred shareholders before common shareholders receive anything.

3. Weighted Average Shares Outstanding: This represents the number of shares outstanding during a period, adjusted for treasury stock transactions, stock splits, and stock dividends.

Example of EPS Calculation

Let's assume a fictional company, XYZ Ltd., that reports a Net Income of INR 10 crore for the financial year. The company has preferred dividends of INR 1 crore and a weighted average of 50 lakh shares outstanding.

\[ \text{EPS} = \frac{10,00,00,000 - 1,00,00,000}{50,00,000} = \frac{9,00,00,000}{50,00,000} = 18 \]

Therefore, the EPS for XYZ Ltd. is INR 18.

Understanding Diluted Earnings Per Share

Apart from the basic EPS, investors also look at the Diluted Earnings Per Share (diluted EPS) to get a complete picture. Diluted EPS takes into account all possible conversion of convertible securities, stock options, and warrants into common stock, offering a more comprehensive picture of the potential dilution of earnings.

Formula for Diluted EPS

The formula is similar to the basic EPS but includes any convertible securities:

\[ \text{Diluted EPS} = \frac{\text{Net Income} - \text{Preferred Dividends}}{\text{Weighted Average Shares Outstanding} + \text{Convertible Securities}} \]

Example of Diluted EPS Calculation

Continuing with XYZ Ltd., let’s assume they have 5 lakh convertible securities that can be converted into common stock. We reconsider the original EPS calculation:

\[ \text{Diluted EPS} = \frac{9,00,00,000}{50,00,000 + 5,00,000} = \frac{9,00,00,000}{55,00,000} \approx 16.36 \]

Thus, the Diluted EPS for XYZ Ltd. is approximately INR 16.36, indicating possible earnings per share if all convertible options are exercised.

Significance of EPS in Investment Decisions

EPS is a popular metric for investment decisions as it provides insight into a company's financial performance. A consistently growing EPS is a good indicator of sound management and successful business strategies. However, investors should analyze other financial metrics alongside EPS, as it doesn't account for debt levels and overlooks capital requirements for maintaining growth.

Factors Influencing EPS

1. Business Growth: High growth often leads to increased net income and a rise in EPS.

2. Share Buybacks: Reducing the number of shares can increase EPS.

3. Dividends: Payment to preferred shareholders can impact EPS calculations.

4. Market Dynamics: Economic conditions and market trends can affect companies’ earnings, thus influencing EPS.

5. Regulatory Changes: Policy and taxation changes can impact net income and earnings calculations.

Conclusion

Calculating EPS and understanding its implications are crucial steps for evaluating the potential success of your investment in a company. While the EPS calculation provides valuable insight, it's vital to be aware of its limitations and supplement it with other financial indicators and market analyses for a well-rounded investment decision.

Disclaimer

This article is a guide for understanding EPS and should not be construed as financial advice. Investors must gauge all the pros and cons of trading in the Indian stock market and consider consulting with financial experts before making any investment decisions. The data used is fictional and for illustrative purposes only.

Written By:

Sophia Robinson

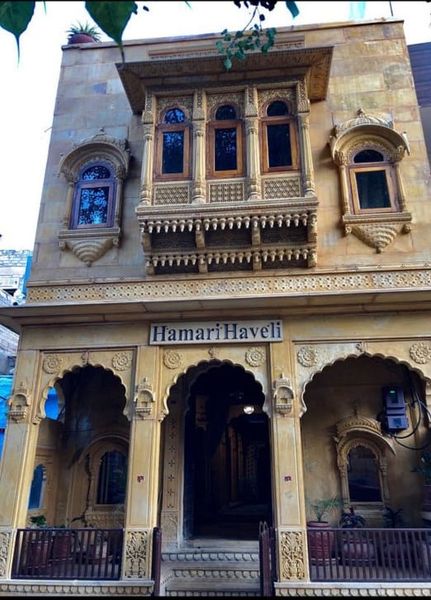

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.