Unlocking Growth: Pharmaceutical Processing Equipment Market Dynamics

Kritika Patil

07 Aug, 2025

15 mins read

7

Kritika Patil

07 Aug, 2025

15 mins read

7

Introduction

In recent years, the pharmaceutical industry has undergone a seismic transformation. This profound shift has been largely catalyzed by the relentless demand for efficient, high-quality drug manufacturing. However, at the very core of this transformation lies a critical driver—the pharmaceutical processing equipment market. Indeed, this market forms the backbone of drug production, facilitating everything from granulation and blending to coating and encapsulation. As the global healthcare landscape evolves, so too does the machinery that powers it. Consequently, understanding the dynamics of this essential market is no longer optional but, rather, absolutely imperative for stakeholders across the pharmaceutical supply chain.

Moreover, due to the continuous introduction of new therapeutics, particularly biologics and personalized medicines, manufacturers are now compelled to adopt more sophisticated, flexible, and automated processing solutions. And because innovation is no longer a luxury but a necessity, pharmaceutical equipment manufacturers are in a race not just to keep up, but to lead. Thus, in this comprehensive guest post, we will delve into the evolution, trends, challenges, and market scope of pharmaceutical processing equipment—offering readers a panoramic yet detailed view of the forces shaping this dynamic industry.

Source: https://www.databridgemarketresearch.com/reports/global-pharmaceutical-processing-equipment-market

The Evolution

To begin with, it is crucial to acknowledge that pharmaceutical processing equipment has come a long way from its rudimentary origins. In the past, manual and semi-automatic tools were sufficient to meet the relatively modest demands of drug production. Yet, as regulations became more stringent and as drug formulations grew more complex, the industry had no choice but to evolve.

Initially, most processing was done using general-purpose industrial equipment with minimal customization. But over time, the unique needs of pharmaceutical production—such as contamination control, dosing precision, and batch integrity—demanded specialized machines. As a result, we witnessed a dramatic shift from basic mixers and dryers to cutting-edge fluid bed processors, automated capsule fillers, and high-speed tablet presses.

Additionally, the advent of computer-aided manufacturing introduced new efficiencies and standards of quality. Consequently, companies began integrating SCADA (Supervisory Control and Data Acquisition) and PLC (Programmable Logic Controllers) systems into their operations. These technologies not only enhanced production efficiency but also ensured regulatory compliance—a major concern in pharma manufacturing. Therefore, it is fair to say that the evolution of pharmaceutical processing equipment has mirrored the industry’s broader transition toward automation, precision, and scalability.

Furthermore, in more recent years, the explosion of biologics has redefined processing requirements. Unlike traditional small-molecule drugs, biologics require highly controlled environments and advanced bioprocessing systems. Consequently, single-use technologies (SUTs) and continuous manufacturing techniques are increasingly taking center stage. All in all, the evolution has been not just technological but philosophical—shifting from quantity-driven to quality-obsessed production strategies.

Market Trends

In order to appreciate where the market stands today, it is essential to analyze the prevailing trends that are actively shaping its trajectory. First and foremost, automation continues to dominate the narrative. As drug makers strive to meet ever-increasing demand without compromising on quality, automated systems are becoming indispensable. These systems not only speed up the production cycle but also minimize human error, which is vital for regulatory compliance.

Another trend worth noting is the growing adoption of continuous manufacturing. Traditionally, pharmaceutical manufacturing has been a batch-oriented process. However, continuous production offers distinct advantages in terms of consistency, cost-efficiency, and scalability. Thus, several major players are now investing heavily in continuous manufacturing technologies, recognizing their potential to revolutionize drug production.

Moreover, sustainability is no longer an afterthought but a strategic priority. Equipment manufacturers are increasingly focusing on eco-friendly designs that reduce energy consumption, minimize waste, and support clean-in-place (CIP) and sterilize-in-place (SIP) protocols. These green technologies not only enhance operational efficiency but also align with corporate social responsibility goals, which are increasingly scrutinized by investors and consumers alike.

Additionally, the market is seeing a surge in demand for modular and flexible processing systems. These systems allow manufacturers to quickly reconfigure their production lines in response to new drug formulations or regulatory changes. Consequently, modularity has become a key selling point, especially for contract manufacturing organizations (CMOs) and smaller biotech firms.

Lastly, it is impossible to ignore the impact of digitalization. From real-time monitoring and predictive maintenance to AI-driven quality assurance, digital technologies are unlocking new levels of performance. Therefore, the convergence of pharma and Industry 4.0 is no longer a future concept—it is already here, and it is fundamentally reshaping how pharmaceutical processing equipment is designed, deployed, and maintained.

Challenges

Despite its impressive growth, the pharmaceutical processing equipment market is not without its hurdles. To begin with, regulatory compliance remains a formidable challenge. Given the sensitive nature of pharmaceutical products, manufacturers must adhere to rigorous standards such as Good Manufacturing Practices (GMP), ISO certifications, and FDA guidelines. As these regulations frequently evolve, keeping equipment compliant can be both costly and time-consuming.

Furthermore, the high capital investment required to procure advanced machinery can deter small and mid-sized enterprises (SMEs). While large pharmaceutical companies often have the resources to invest in state-of-the-art systems, SMEs may find themselves constrained by budget limitations. Consequently, there exists a clear disparity in technological adoption across different segments of the market.

In addition to financial constraints, the complexity of integrating new equipment with existing infrastructure poses another challenge. Retrofitting older facilities with modern machinery can be a logistical nightmare, often requiring extensive downtime and costly modifications. This challenge is particularly acute in emerging markets, where legacy systems are still prevalent.

Moreover, there is a growing shortage of skilled labor capable of operating and maintaining sophisticated processing equipment. As automation becomes more prevalent, the demand for specialized technicians and engineers is skyrocketing. Unfortunately, talent development has not kept pace with this demand, creating a significant skills gap.

Lastly, geopolitical instability and supply chain disruptions continue to exert pressure on the market. The COVID-19 pandemic, for example, highlighted the vulnerabilities of global supply chains and underscored the need for localized manufacturing capabilities. As a result, companies are increasingly seeking equipment suppliers who can offer not only technological excellence but also supply chain resilience.

Market Scope

As we shift focus to the market scope, it becomes abundantly clear that the pharmaceutical processing equipment sector holds vast potential across both developed and emerging economies. On one hand, mature markets such as North America and Western Europe boast well-established pharmaceutical industries, advanced infrastructure, and robust regulatory frameworks. Consequently, these regions represent significant demand for high-end, automated processing systems.

On the other hand, emerging markets such as Asia-Pacific, Latin America, and the Middle East are experiencing exponential growth in pharmaceutical manufacturing. Factors such as increasing healthcare expenditure, favorable government initiatives, and the rise of local pharmaceutical companies are fueling equipment demand in these regions. Moreover, the trend of contract manufacturing is particularly strong in Asia, further expanding the market scope.

Additionally, the market extends across a diverse range of product types including solid dosage equipment, liquid processing machinery, and semi-solid systems. Each of these segments has its own set of requirements and growth drivers. For instance, solid dosage forms such as tablets and capsules continue to dominate the market due to their ease of administration and longer shelf life. Therefore, equipment designed for granulation, compression, and coating sees sustained demand.

Furthermore, the scope of application is not limited to human pharmaceuticals alone. Veterinary drugs, nutraceuticals, and even certain cosmetics also require pharmaceutical-grade processing equipment. This broad application spectrum ensures a steady stream of opportunities for equipment manufacturers, distributors, and service providers alike.

Market Size

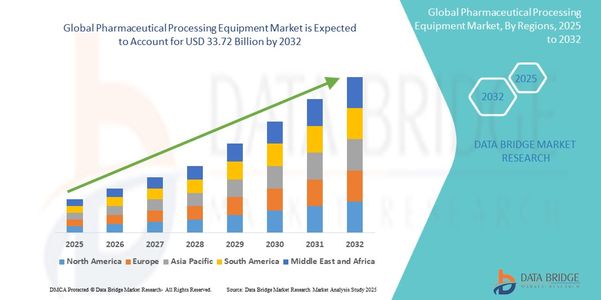

In quantitative terms, the pharmaceutical processing equipment market has witnessed remarkable growth over the past decade. With escalating global demand for medicines, both generic and branded, the market has expanded at a rapid pace. Although exact figures may vary by source, industry estimates place the market valuation in the tens of billions of dollars—and it continues to grow at a healthy compound annual growth rate (CAGR).

Notably, a significant portion of this growth can be attributed to the rising popularity of biologics and specialty drugs, which require specialized processing equipment. Additionally, the surge in chronic diseases, aging populations, and global health crises like pandemics have further accelerated drug production, thereby boosting equipment sales.

Geographically, Asia-Pacific is emerging as the fastest-growing region, thanks to its cost-effective manufacturing, supportive regulatory landscape, and expanding middle class. Meanwhile, North America remains the largest market, driven by continuous R&D, high healthcare spending, and rapid adoption of new technologies.

Looking ahead, the market shows no signs of slowing down. Investments in continuous manufacturing, digital twins, and AI integration are expected to further propel the market size in the coming years. Furthermore, as pharmaceutical companies strive to enhance speed-to-market, equipment that enables flexible, scalable, and compliant production will continue to be in high demand.

Factors Driving Growth

Clearly, numerous factors are converging to drive the expansion of the pharmaceutical processing equipment market. To begin with, the most obvious driver is the increasing global demand for pharmaceutical products. As populations grow, age, and become more health-conscious, the consumption of medications continues to rise. This surge in demand directly translates into a need for faster, more efficient drug manufacturing capabilities.

Another powerful growth driver is the continuous stream of new drug approvals. Every time a new therapy enters the market, particularly those with complex formulations, there arises a corresponding need for specialized processing equipment. Therefore, the innovation pipeline in pharma is inherently linked to equipment market growth.

In addition, the ongoing trend of personalized medicine is pushing the envelope for flexible and modular processing systems. These technologies allow manufacturers to swiftly switch between different formulations and batch sizes—an essential requirement for personalized treatments.

Moreover, regulatory agencies are increasingly promoting quality by design (QbD) and process analytical technology (PAT). These frameworks encourage manufacturers to build quality into the production process from the outset. Consequently, there is rising demand for equipment that supports real-time monitoring, feedback loops, and data analytics.

Furthermore, government incentives, funding for pharmaceutical infrastructure, and public-private partnerships are providing a favorable environment for market expansion. Many countries are investing in pharmaceutical hubs and special economic zones, which include state-of-the-art processing facilities. These initiatives not only boost local manufacturing but also attract global equipment vendors.

Finally, the shift toward value-based healthcare is placing greater emphasis on drug efficacy, safety, and production integrity. As a result, pharmaceutical companies are under pressure to deliver consistent, high-quality products—making advanced processing equipment not just desirable but essential.

Conclusion

In conclusion, the pharmaceutical processing equipment market stands as a pillar of modern medicine. Its evolution from simple mixers to smart, integrated systems has paralleled the transformation of the pharmaceutical industry itself. Moreover, the market’s robust growth is fueled by a potent combination of technological advancement, regulatory evolution, and increasing demand for healthcare solutions.

Although challenges persist—from regulatory complexity to infrastructure limitations—these are far outweighed by the opportunities on offer. With emerging markets opening up, digital technologies gaining ground, and continuous innovation redefining what's possible, the future of this market is not only promising but also pivotal to global health outcomes.

Therefore, for investors, manufacturers, and healthcare stakeholders alike, engaging with the pharmaceutical processing equipment market is not just a strategic move—it is a vital imperative for staying relevant in an ever-evolving landscape.

Written By:

Kritika Patil

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.