"Buy Now Pay Later Market: Redefining Consumer Credit"

Kevin Muench

23 May, 2025

13 mins read

15

Kevin Muench

23 May, 2025

13 mins read

15

Buy Now Pay Later Market Size

According to Market.us's research, the Global Buy Now Pay Later (BNPL) Market is expected to reach around USD 115 Billion by 2032, rising significantly from USD 16 Billion in 2023, at a strong CAGR of 25.3% over the forecast period from 2023 to 2032. The market's rapid growth is fueled by increased consumer preference for flexible payment solutions, widespread e-commerce adoption, and the integration of BNPL services across online and offline retail platforms.

The global BNPL market has experienced substantial growth in recent years. Several factors are propelling the BNPL market forward. The rise in online shopping, especially among tech-savvy consumers, has led to greater adoption of BNPL services. Additionally, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) has enhanced credit risk assessments and personalized payment options, further attracting users . Moreover, strategic partnerships between BNPL providers and major retailers have expanded the reach and accessibility of these services.

Download a Free Sample before buying - https://market.us/report/buy-now-pay-later-market/request-sample/

According to a February 2023 survey by Forbes Advisor, the usage of cash for shopping has declined to just 9% among Americans, signaling a pronounced shift in consumer payment behavior. In contrast, 54% of shoppers now rely primarily on debit and credit cards, underscoring the growing dominance of digital and card-based payment solutions across retail channels. This transformation reflects not only changing consumer preferences but also broader advancements in financial technology infrastructure and digital commerce.

This trend is further evidenced by data from Adobe Analytics, which reported a 20% year-over-year increase in the adoption of Buy Now, Pay Later (BNPL) options during the 2023 Amazon Prime Day Sale. The surge in BNPL usage highlights consumers' increasing demand for flexible, installment-based payment alternatives, particularly in e-commerce environments where convenience and short-term liquidity are critical drivers of purchase decisions.

In parallel, the U.S. Federal Reserve notes that credit card utilization currently stands at around 21%, reflecting steady consumer reliance on revolving credit. As BNPL services become integrated with traditional credit card offerings, this hybrid model has the potential to significantly expand consumer access to credit. Industry projections estimate that such integration could boost U.S. credit limits to approximately USD 1.28 trillion by 2025, representing a substantial growth opportunity for financial institutions.

Key Takeaways

- In 2022, the online segment dominated the Buy Now, Pay Later (BNPL) market, capturing over 62% of the total share, reflecting the rapid integration of BNPL services into e-commerce platforms and rising consumer preference for digital shopping.

- Large enterprises accounted for more than 61% of the BNPL market in 2022, leveraging these solutions to enhance customer loyalty, increase basket sizes, and attract price-sensitive buyers.

- The retail sector showed the highest uptake of BNPL services, securing over 71.3% market share in 2022, as merchants increasingly adopted flexible payment options to drive sales conversions and improve affordability for shoppers.

- North America led the regional BNPL landscape in 2022, commanding over 32% of the market and generating approximately USD 4.6 Billion in revenue, driven by early consumer adoption and strong merchant partnerships.

Market Overview

The demand for BNPL services is particularly high among younger consumers. A recent study indicated that 64% of Generation Z consumers have utilized BNPL loans, compared to 29% of Baby Boomers . This trend underscores the appeal of BNPL solutions to demographics that prioritize convenience and financial flexibility.

Technological advancements are central to the evolution of BNPL services. Providers are leveraging AI and ML to improve credit risk assessments and tailor payment plans to individual consumer needs . These innovations not only enhance user experience but also mitigate potential defaults by ensuring that payment plans align with consumers' financial capacities.

Consumers are drawn to BNPL services for several reasons. The ability to manage cash flow effectively, make larger purchases more affordable, and avoid traditional credit card debt are significant motivators. Additionally, the straightforward and transparent nature of BNPL agreements appeals to users seeking simplicity in financial transactions.

Analysts Viewpoint

The BNPL sector presents numerous investment opportunities. The projected market growth, coupled with increasing consumer adoption, makes it an attractive area for investors. Companies like Affirm have demonstrated resilience and growth potential, with recent partnerships, such as the one with Costco, enhancing their market position .

Businesses benefit from integrating BNPL options by attracting a broader customer base and increasing average order values. Offering flexible payment solutions can lead to higher conversion rates and customer satisfaction, fostering brand loyalty and repeat purchases.

The regulatory environment for BNPL services is evolving. In the United Kingdom, the government plans to implement regulations requiring BNPL providers to conduct affordability checks and offer clearer information about terms and conditions. These measures aim to protect consumers and ensure responsible lending practices within the industry.

Key factors impacting the BNPL market include technological integration, consumer behavior shifts, and regulatory developments. The adoption of AI and ML enhances service offerings, while changing consumer preferences drive demand. Simultaneously, regulatory frameworks are being established to safeguard consumers and maintain market integrity.

Emerging Trends

- Regulatory Oversight Enhancements: Governments are introducing regulations to oversee BNPL providers, aiming to ensure consumer protection and financial stability. For instance, the UK plans to bring BNPL services under the Financial Conduct Authority's supervision.

- Integration with Mobile Wallets: BNPL services are increasingly being integrated into mobile wallets, enhancing user convenience and expanding the reach of BNPL options.

- Shift Towards Essential Purchases: Consumers are utilizing BNPL for everyday necessities, such as groceries, indicating a shift from discretionary to essential spending.

- Adoption by Traditional Financial Institutions: Established banks are entering the BNPL space, either through partnerships or by developing their own solutions, to remain competitive in the evolving financial landscape.

- Emphasis on Responsible Lending: BNPL providers are focusing on responsible lending practices, including credit checks and transparent terms, to mitigate risks and build consumer trust.

Top Use Cases

- E-commerce Transactions: BNPL is widely used for online shopping, allowing consumers to spread the cost of purchases over time.

- In-store Retail Purchases: Retailers are offering BNPL options at physical locations, providing customers with flexible payment choices at the point of sale.

- Healthcare Services: Patients are using BNPL to manage medical expenses, making healthcare more accessible by breaking down costs into manageable payments.

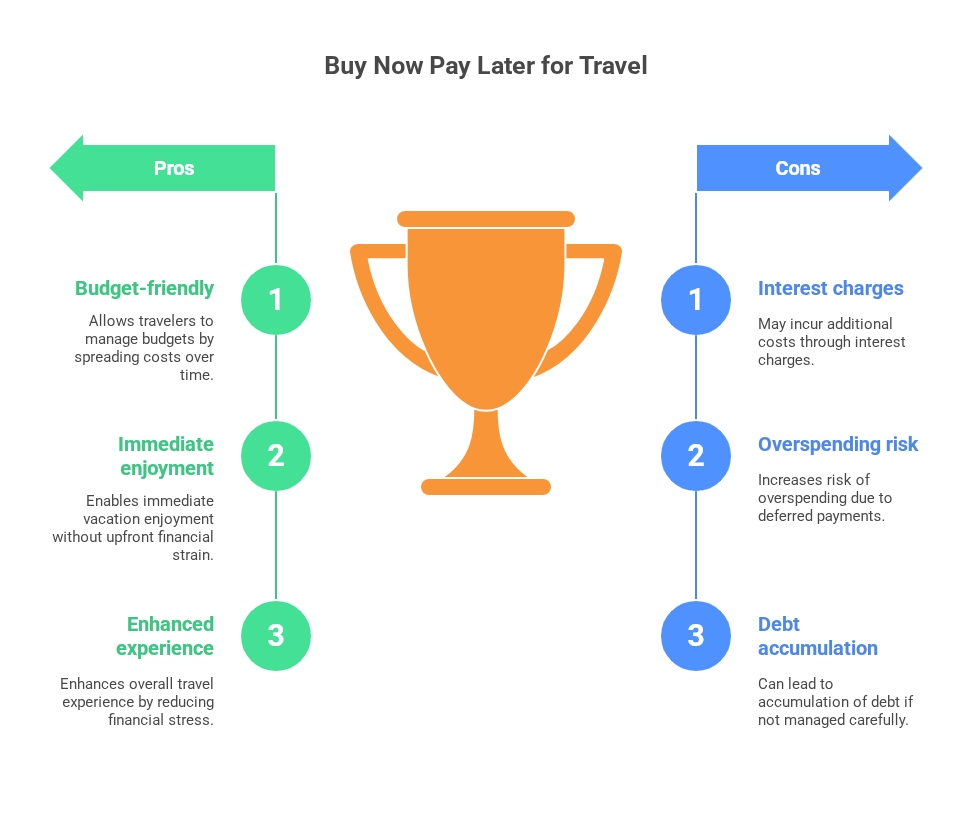

- Travel and Leisure Bookings: BNPL facilitates travel planning by allowing consumers to pay for trips and leisure activities in installments.

- Educational Expenses: Students and learners are leveraging BNPL to finance educational courses and materials, easing the financial burden of upskilling.

Attractive Opportunities

- Expansion into Emerging Markets: There is significant potential for BNPL growth in emerging economies, where access to traditional credit is limited.

- Partnerships with Small and Medium Enterprises (SMEs): Collaborating with SMEs can help BNPL providers tap into new customer bases and support business growth.

- Integration with Subscription Services: BNPL can be applied to subscription-based models, offering consumers flexible payment options for recurring services.

- Development of Proprietary BNPL Platforms by Retailers: Retailers creating their own BNPL solutions can enhance customer loyalty and control over the payment experience.

- Leveraging Artificial Intelligence for Credit Assessment: Implementing AI-driven credit assessment tools can improve risk management and personalize BNPL offerings.

Recent Developments

- In March 2025, Starlink Qatar entered a strategic collaboration with PayLater to introduce Buy Now, Pay Later (BNPL) services across all Starlink retail locations in Qatar. This partnership aims to enhance customer experience by offering flexible installment-based payment options, enabling consumers to shop according to their preferences and financial convenience. The initiative aligns with the growing regional trend toward consumer-centric financing solutions and supports greater accessibility to high-value technology products.

- Earlier in December 2024, equipifi partnered with Synergent to empower Synergent’s network of credit unions with the tools to launch their own BNPL programs through integrated digital banking apps. This collaboration provides credit union members with the ability to split large purchases into manageable installment loans, thereby increasing member engagement and aligning traditional financial institutions with evolving consumer credit expectations in the digital age.

- In September 2024, Sunbit expanded its reach through a strategic alliance with Stripe, aimed at delivering Sunbit’s BNPL capabilities to a wider network of in-person service businesses. Through this agreement, merchants utilizing Stripe’s payment infrastructure are now equipped with access to Sunbit’s point-of-sale installment solutions.

Top Companies

- Affirm, Inc.

- Afterpay Pty Ltd

- com, Inc.

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Other Key Players

Conclusion

In conclusion, the Buy Now, Pay Later market is poised for continued growth, driven by technological advancements, consumer demand for flexible payment options, and evolving regulatory landscapes. As the market matures, stakeholders must navigate these dynamics to capitalize on emerging opportunities and address potential challenges effectively.

window.NREUM||(NREUM={});NREUM.info={"beacon":"bam.nr-data.net","licenseKey":"NRJS-3109bb2e2783f515265","applicationID":"558315209","transactionName":"blUHbEVQCxECBUVQWVcfMEpeHhARBhRCFlRVXwIXVEMAAxcDU1VZXh4VUEc=","queueTime":0,"applicationTime":137,"atts":"QhIEGg1KGB8=","errorBeacon":"bam.nr-data.net","agent":""}

Written By:

Kevin Muench

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.