Benefits of Integrating Trading Software with Financial Tools

Aya Basha

16 Apr, 2025

12 mins read

131

Aya Basha

16 Apr, 2025

12 mins read

131

The modern, fast-expanding economic world relies heavily upon traders and investors, permeated by technology, for the efficient management of their activities. Integrating trading software with various financial tools is among the most prized innovations in this environment. This forms a powerful ecosystem that enables users to enhance decision-making capabilities, analyse live data, and smoothly attend to operations. Thus, this integration aids both individual traders and institutional investors in reducing the manual effort involved, which minimizes errors while providing better insight into market trends. The trend toward trading on digital platforms makes this integrated approach theory rather than some optional path to proper competitiveness and accuracy.

Trading software is meant to facilitate users in making purchase and sell transactions of financial instruments, including stocks, forex, and commodities. By itself, it already provides sound groundwork for making trades and analysing markets. When integrated with the likes of accounting software, portfolio trackers, and risk management systems, the value of trading software is further enhanced. Traders can do process automation for reporting, synchronize data across different platforms, and gain a consolidated view regarding their financial performance. This not only saves time, but it also entails strategic planning, promoting efficiency and easing trading for users, regardless of experience level.

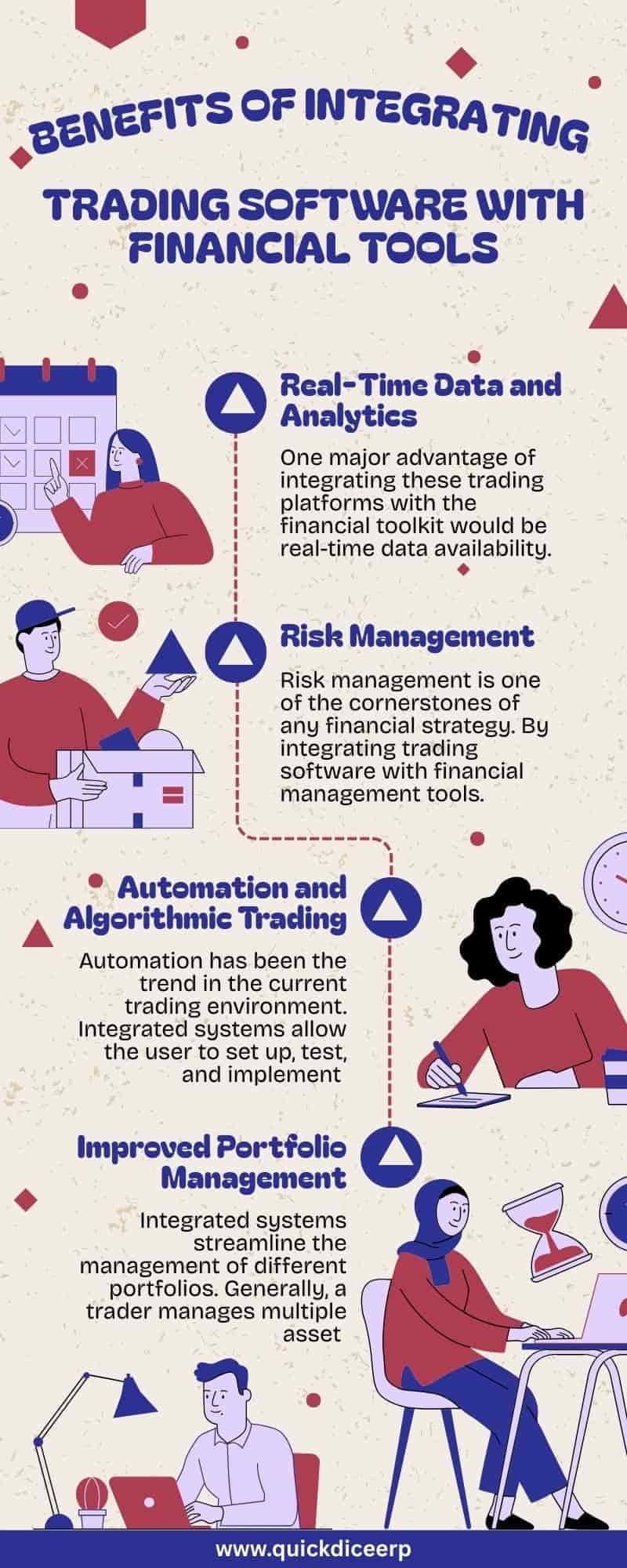

Here are some of the Benefits of Integrating Trading Software with Financial Tools.

1. Real-Time Data and Analytics

One major advantage of integrating these trading platforms with the financial toolkit would be real-time data availability. Among various available software, trading software can be linked to analytic tools like Bloomberg, Terminal, Meta Trader, and other financial APIs to provide hour-by-hour changes in market prices, trading volumes, news, and economic indicators.

Real-time insights help traders to make the right decision quickly. They can respond to market happenings as they occur and not depend on news from late reports. With access to sophisticated tools for charting, algorithmic modeling, and AI-based forecasts, users are able to analyse trends better and with greater confidence identify entry and exit points.

2. Risk Management

Risk management is one of the cornerstones of any financial strategy. By integrating trading software with financial management tools, traders are given opportunities to recognize and manage risks like never before. Portfolio trackers, calculators of volatility, and margin surveillance systems contribute to assessing exposure and effective management of leverage.

For instance, the integration of traders' platforms with a dashboard for risk management could prompt automated alerts when trades are in violation of a preset risk threshold. This, in turn, allows for simulation tests or "what-if" scenarios to be run before live trades are completed. Such devices capitalize on avoiding potential high-cost error possibilities while squeezing some extra miles towards capital preservation.

3. Automation and Algorithmic Trading

Automation has been the trend in the current trading environment. Integrated systems allow the user to set up, test, and implement trading algorithms running without further human intervention. These include algorithmic strategies based on technical indicators or sent via news on sentiment or highly sophisticated, frankly speaking, quantitative models.

Trading software, when linked with financial tools that feed live market data and statistical models, enable traders to automate the entire process from scanning the market place to placing trades and managing positions. This would save a lot of time and also eliminate emotions attached to trading for consistent results.

Automated back testing can thus be used to assess the performance of any trading strategy on historical data. This parameter allows traders to fine-tune their methods and further enhance profitability.

4. Improved Portfolio Management

Integrated systems streamline the management of different portfolios. Generally, a trader manages multiple asset classes such as stocks, forex, commodities, ETFs, and cryptocurrencies. Financial tools integrated with trading software provide a centralized view of holdings, performance metrics, and asset allocations.

Investors can set goals, monitor progress, and even rebalance their portfolios in real-time, depending on market data. Integrated systems also help ensure proper recordkeeping of trades and performance, all of which are important for tax and performance evaluation purposes.

Additionally, by integrating portfolios, users may access advanced analytics, such as calculating their Sharpe ratio, correlation matrix, and diversification models, which would enable them to make wise investment decisions.

5. Seamless Financial Reporting and Compliance

Today, much modern trading falls under a wide range of regulatory requirements and reporting standards. Integrated trading systems facilitate this by automating the generation of financial reports and compliance documentation.

Taking an example, if there was a requirement generated by a trader for capital gains reports or maintenance logs for audits, the integrated financial software could fetch all the data organized into a compliance-ready format. Also, tools for tax can be integrated with trading platforms to provide real-time calculations of liabilities enabling users to be ready ahead of tax seasons.

For businesses or institutional traders, now the integration with ERP (Enterprise Resource Planning) or accounting systems allows financial data from trading to flow directly into financial statements and ledgers. This reduces errors, minimizes manual working, and ensures timely, accurate financial disclosures.

6. Quicker Decision-Making and Execution

Speed is key in this world of trading: a small delay in execution may cause losses or fail to gain opportunities. Integration minimizes latency between the time when a decision is made and the action taken.

Traders now get instant recommendations and alerts for linking trading software with financial analytics. They can be generated by defined strategies, breaking news, or market anomalies. And, because trades can be executed in less than a millisecond with one-click execution and order placement, users enjoy an advantage in fast-moving markets without missing the opportunity.

In institutions, integrated with order management systems (OMS) and execution management systems (EMS), orders generate trade executions, whose efficiency is both maximized and described as best practice.

7. Customization and User Experience Improvements

Every individual has their own personalized ways of trading, and their own trading strategies. An integrated system enables users to have their own personalized trading environment. A lot of platforms have dashboards featuring customized views which are capable of showing only that relevant information, indicators and charts.

Users will be able to design workflows in which certain financial events trigger automatic actions such as rebalancing a portfolio once a threshold is crossed by a stock. This indeed brings much closer attention that the trader has on the core strategies while reducing interruptions.

The integrated platforms are often cloud-based and mobile-app accessible, so a trader can monitor or trade with relative ease from anywhere in the world.

8. Scaling and Flexibility

As the amounts traded and the complexity of trading increase, systems can be integrated in such a way that they will scale pointlessly. Traders simply add new financial tools and APIs without having to reinstall the whole system. In particular, when expanding to other markets or certain instruments, or even into a larger team, integration takes the strain off of scalability issues.

Moreover, such an architecture can be an awesome boon for startups, hedge funds, and asset managers willing to structure their operations in a lean manner, allowing easy adoption of future requirements at minimal cost and downtime.

Conclusion

All advantages presented by the integration between trading software and financial tools certainly go beyond mere conveniences. It provides a smarter, faster, and more precise means of handling trades and tracking financial performance. The benefit of accessing real-time data, automating processes, and minimizing human error translates to providing a favourable trading experience. Traders are now endowed with insights and agility to stay ahead in dynamic markets. This combination ensures that traders are, therefore, not only reacting to market conditions but are also able to plan with full clarity on their financial health.

In conclusion, an integrated approach to trading software and financial tools is an advancement for anyone wanting to trade more effectively. Traced in this way, the productivity gains, operational cost reductions, and insight into data-driven decision-making all follow on. As technology continues to advance, so will the appeal for cutting-edge financial solutions. Those businesses and individuals willing to invest in this integrated approach will place themselves in a position of strength for long-term success in the financial marketplace. It is, therefore, not merely about smart trading-it is about making confident and clear decisions with respect to the management of one's financial future.

Written By:

Aya Basha

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.