Credit Card Payment Market: Growth, Trends, and Opportunities

Amo Shek

30 Sep, 2025

9 mins read

21

Amo Shek

30 Sep, 2025

9 mins read

21

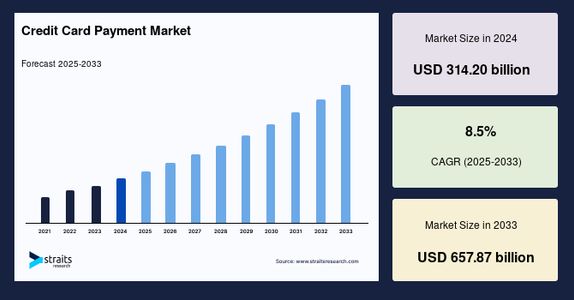

The global credit card payment market is experiencing steady growth, fueled by the rising demand for cashless transactions, the expansion of e-commerce, and innovations in payment infrastructure. The market is expected to grow significantly in the coming years, moving from over USD 340 billion in 2025 to nearly USD 660 billion by 2033, at a compound annual growth rate (CAGR) of 8.5%.

North America currently dominates the market, holding more than 40% share due to its advanced payment systems, high consumer spending, and widespread adoption of credit cards. At the same time, Asia-Pacific is anticipated to record the fastest growth as financial inclusion improves, digital infrastructure expands, and consumer adoption of electronic payments accelerates.

Credit cards today are no longer just plastic payment tools; they are evolving into multi-functional digital instruments integrated with mobile wallets, contactless payment solutions, and embedded finance platforms. This transformation is reshaping consumer behavior and the broader payments ecosystem.

Request a Sample Report@ https://straitsresearch.com/report/credit-card-payment-market/request-sample

Market Restraints

Despite the promising outlook, the industry faces several challenges:

- Regulatory Pressure: Interchange fees and merchant charges continue to attract scrutiny, leading to potential revenue pressures for card issuers and networks.

- Credit Risks: Rising defaults and economic uncertainty may increase delinquencies, putting pressure on issuers.

- Intensifying Competition: Digital wallets, Buy Now Pay Later (BNPL), and real-time payments are increasingly competing with traditional credit card solutions.

- Infrastructure Limitations: In emerging economies, weak financial infrastructure and low card acceptance can restrict market penetration.

Opportunities

There are also abundant opportunities for growth:

- Emerging Market Expansion: Growing digital literacy and financial inclusion create fertile ground for card issuers.

- Technological Advancements: Integration with mobile apps, tokenization, virtual cards, and AI-driven fraud detection offer new avenues for adoption.

- Co-Branded and Partnership Models: Collaborations between banks, retailers, and fintechs can drive consumer loyalty and broaden reach.

- Cross-Border Growth: The rise of international e-commerce is boosting demand for virtual cards and seamless global transactions.

- Value-Added Services: Using transaction data for loyalty programs, personalized offers, and customer insights provides additional revenue streams.

Market Segments

The credit card payment market can be segmented into the following categories:

- By Card Type: General purpose credit cards and specialty credit cards.

- By Brand/Provider: Visa, Mastercard, and other networks.

- By Application: Food and groceries, healthcare and pharmacy, restaurants and bars, electronics, entertainment, travel and tourism, e-commerce, and others.

General purpose credit cards currently dominate, holding a significant majority share. Among providers, Visa continues to be a market leader, with Mastercard and others playing strong supporting roles.

Purchase the Full Report@ https://straitsresearch.com/buy-now/credit-card-payment-market

Key Players

The market is shaped by major global institutions and networks, including:

- American Express

- Bank of America

- Barclays

- Capital One

- Citigroup

- JPMorgan Chase & Co.

- Mastercard

- Synchrony

- PNC Financial Services

- USAA

In addition to traditional players, global payment processors and fintech innovators are increasingly influencing the market through partnerships and technology-driven services.

Latest Developments and Collaborations

Recent industry developments highlight two major trends: innovation and collaboration. Card networks and issuers are investing heavily in contactless technology, AI-based fraud prevention, and tokenized transactions to enhance security and convenience. Co-branded card partnerships are expanding across retail, travel, and e-commerce sectors, while fintech collaborations are embedding credit card services into mobile-first ecosystems.

At the same time, regulatory bodies in several regions are taking a closer look at interchange fees and competitive practices, pushing companies to innovate with cost-effective solutions for merchants. Emerging initiatives in B2B credit card payments are also unlocking new opportunities in corporate and small business segments.

FAQs

Q1. How large is the credit card payments market?

The market is projected to grow from over USD 340 billion in 2025 to around USD 660 billion by 2033.

Q2. Which segment leads the market?

General purpose credit cards hold the largest share, with Visa being a leading provider.

Q3. What factors are restraining growth?

Key challenges include regulatory pressure on merchant fees, rising credit risk, competition from alternative payment methods, and limited infrastructure in some regions.

Q4. Who are the major players?

Top players include American Express, Visa, Mastercard, Bank of America, Citigroup, and JPMorgan Chase, alongside several fintech and payment processors.

Q5. What are the key trends to watch?

Key trends include growth in virtual and tokenized cards, embedded finance integration, co-branded partnerships, and expansion into B2B payments.

Conclusion

The credit card payment market remains a vital pillar of the global financial ecosystem. Although it faces headwinds from regulatory challenges, credit risks, and competing payment methods, its growth trajectory remains positive. Innovations in digital infrastructure, emerging market expansion, and strategic partnerships will continue to drive the industry forward.

For issuers, networks, and fintechs, the next phase of success lies in reimagining credit card offerings as seamless, digital-first tools that not only enable payments but also deliver value-added services and customer engagement.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Written By:

Amo Shek

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.