Guide to Implementing ZATCA Phase 2 in Your Business

Aya Basha

15 Mar, 2025

7 mins read

86

Aya Basha

15 Mar, 2025

7 mins read

86

All businesses operating in Saudi Arabia need to understand ZATCA Phase 2 regulations because they ensure operational compliance as well as financial stability. The Zakat Tax and Customs Authority (ZATCA) requires businesses to integrate their e-invoicing platforms with their system through Phase 2 of its digital tax transformation program called the Integration Phase. The system provides instant invoice validation and full transparency and automated tax documentation. Businesses face an obligation to update their invoicing systems since the new regulations require careful preparation and informed knowledge about the changes.

The implementation requirements of ZATCA Phase 2 include both structured e-invoicing formats with cryptographic stamping and secure integration to ZATCA's Fatoora platform. The updated regulations seek to improve tax management by enhancing operational efficiency and stopping fraudulent activities within different industrial sectors. Organizations which execute correct planning and implement suitable e-invoicing solutions will achieve compliance without encountering operational disruptions. The following guide provides all crucial information about ZATCA Phase 2 through a complete breakdown of requirements as well as implementation steps and smooth transition methods for your business.

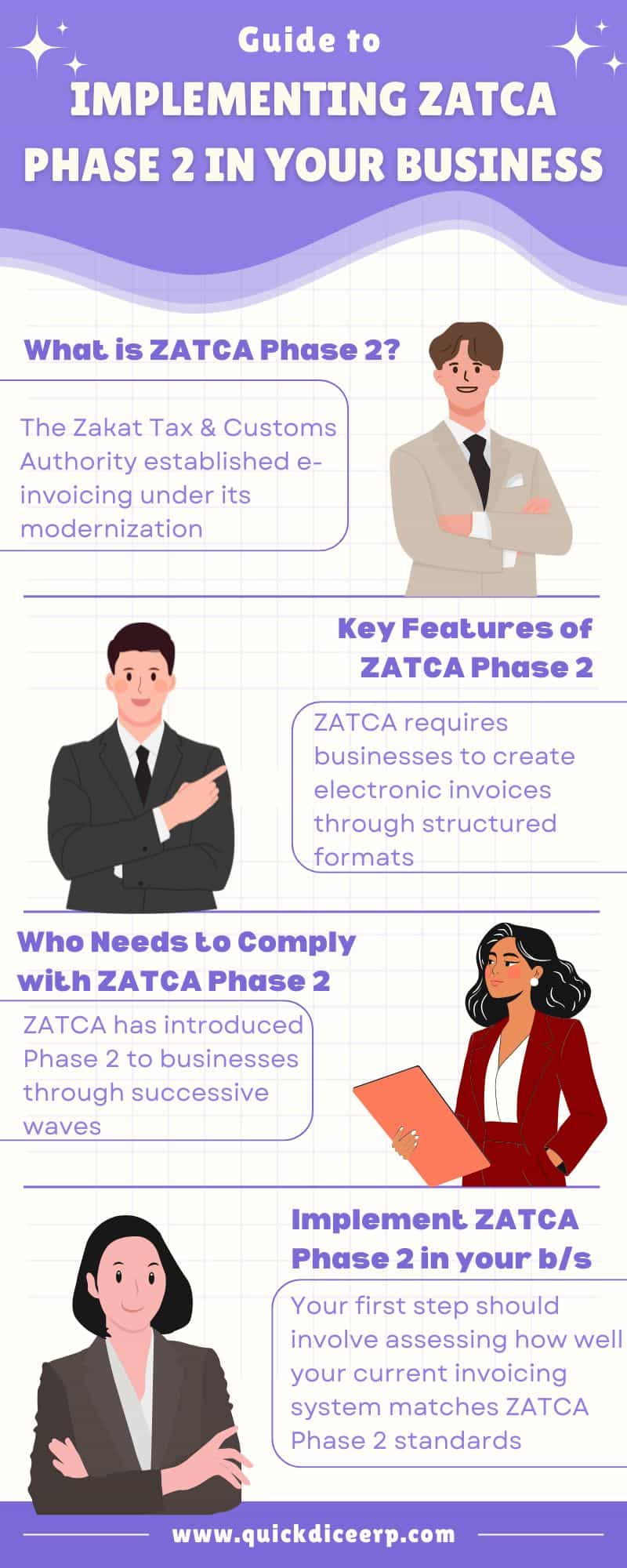

What is ZATCA Phase 2?

The Zakat Tax and Customs Authority (ZATCA) established e-invoicing under its modernization initiative for Saudi Arabian tax compliance. The Generation Phase under Phase 1 mandated e-invoice production from businesses while Phase 2 concerns ZATCA system connection for real-time reporting.

Key Features of ZATCA Phase 2:

- ZATCA requires businesses to create electronic invoices through structured formats either as XML or PDF/A-3 with embedded XML.

- Fatoora platform from ZATCA requires business invoicing systems to become integrated.

- All invoices must carry cryptographic stamps together with a UUID (Unique Universal Identifier).

- ZATCA Phase 2 brings forth transparency along with efficiency to match Saudi tax regulations.

Who Needs to Comply with ZATCA Phase 2?

ZATCA has introduced Phase 2 to businesses through successive waves that divide companies based on their annual revenue amount.

- Large taxpayers with annual revenue exceeding 3 billion SAR become the first to comply during Wave 1 beginning January 1, 2023.

- The second wave of ZATCA Phase 2 compliance applies to all businesses earning revenue exceeding 500 million SAR from July 1, 2023.

- Zone 3 together with additional businesses continue to join the ZATCA compliance requirements.

- All companies that match these descriptions must begin preparing their e-invoicing system.

Steps to Implement ZATCA Phase 2 in Your Business

1. Assess Your Current E-Invoicing System

Your first step should involve assessing how well your current invoicing system matches ZATCA Phase 2 standards. Non-compliant systems need you to select an approved solution or implement an upgrade to match the requirements.

2. Choose a ZATCA-Compliant E-Invoicing Solution

Your e-invoicing solution should:

- Your system should produce invoices in either the XML or PDF/A-3 format.

- The system should enable cryptographic stamping together with QR code functionality.

- The system should link directly to ZATCA's Fatoora platform for continuous reporting capabilities.

3. Register & Integrate with ZATCA

Your invoicing system requires connection to ZATCA's platform for operation. This involves:

- Registering your system with ZATCA.

- A secure Application Programming Interface must be implemented to exchange data.

- System tests need to be performed before activating it.

4. Train Your Staff

The finance and accounting staff must acquire expertise to create and operate ZATCA Phase 2-ready invoices. Provide training on:

- New invoicing formats

- Integration procedures

- Handling errors or rejections

5. Monitor & Stay Updated

Monitor ZATCA tax regulations because they change frequently. By conducting regular audits and compliance checks your business can prevent getting penalized.

Benefits of Complying with ZATCA Phase 2

Non-compliance leads to penalties for which businesses must pay fines.

The use of digital invoices speeds up invoice processing while decreasing human errors as well as manual workload.

Real-time tracking makes financial transparency better through improved financial control.

Automated integration through the system enables smooth tax reporting operations.

Conclusion:

Businesses in Saudi Arabia must undertake essential steps to meet the present ZATCA Phase 2 e-invoicing regulations. The adoption of appropriate e-invoicing solutions together with Fatoora platform integration with ZATCA enables businesses to achieve efficient tax reporting and prevent taxation-related penalties. The new regulatory framework will be accessible to your business through proactive measures and system upgrades together with proper team training.

Businesses need to monitor ZATCA Phase 2 implementation schedule because the framework operates through multiple phases. Your success at transitioning depends on both the implementation of ZATCA-approved e-invoicing solutions and attainable system connection to tax authority platforms. The adoption of new changes will help businesses build better financial transparency and operational efficiency which supports Saudi Arabia's goal to create a fully automated tax ecosystem.

Written By:

Aya Basha

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.