How the Best ERP Software Helps in VAT & ZATCA Compliance

Aya Basha

13 May, 2025

10 mins read

23

Aya Basha

13 May, 2025

10 mins read

23

The awareness of legal taxes in any region has been highly important in the current world business environment. It becomes imperative for all the companies and firms to follow the rules of VAT and ZATCA for their business in Saudi Arabia. It is now possible for companies to implement solutions which will positively affect the ways of performing these complicated tasks due to the constant evolution of digital tax systems and regulations. This is where the best ERP system in Saudi Arabia is a helpful tool that can be used by each business that wants to optimize its financial procedures, as well as minimize unnecessary errors and violations of the law.

It means that any implementation of an effective ERP system can assist the businesses to calculate the VAT and integrate with the digital platforms of the ZATCA while making all financial activities in line with the tax laws of the country. Thus, proper use of efficient ERP solution helps companies to handle their tax responsibilities more effectively, decrease the possibility to face penalties and devote more time to the strategic development. This is because the leading ERP system in Saudi Arabia can help the businesses in dealing with the VAT and ZATCA compliance with limited risk of human intervention and the possibility of errors.

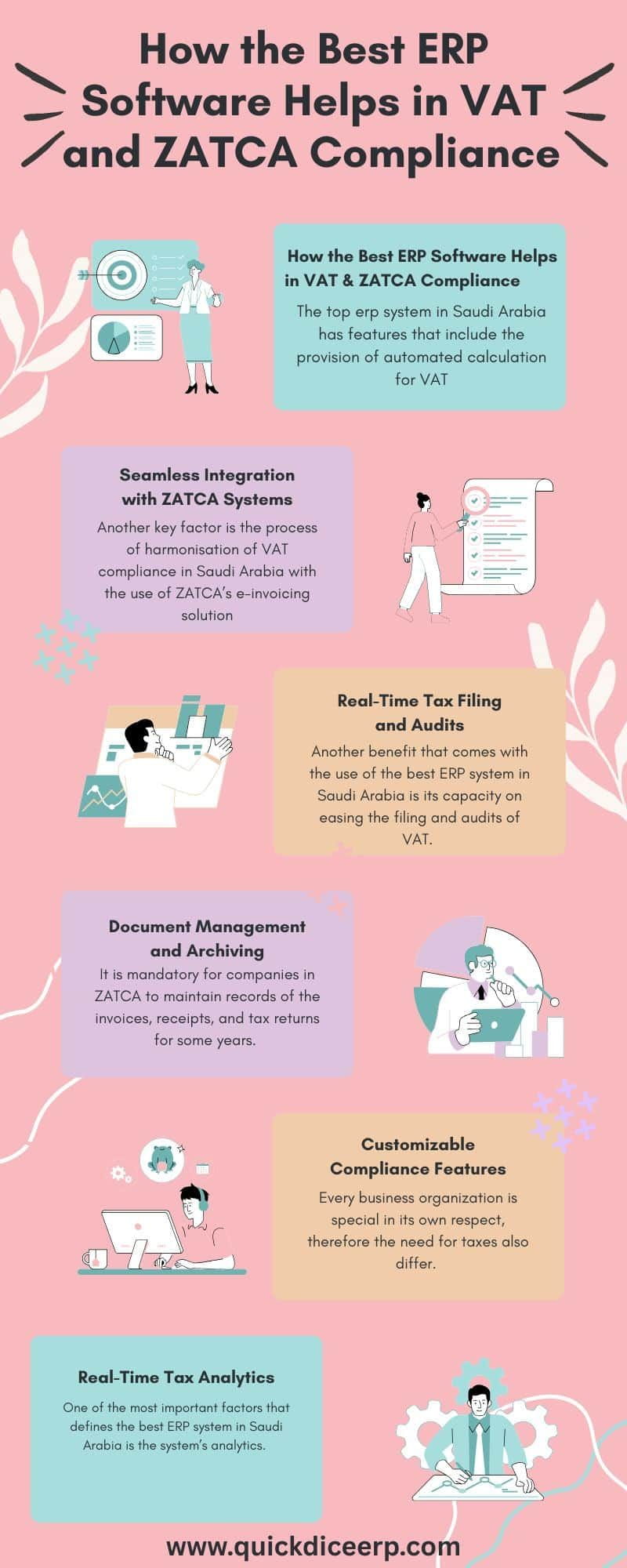

Here are the Tips How the Best ERP Software Helps in VAT & ZATCA Compliance

1. Automated VAT Calculation and Reporting

The top erp system in Saudi Arabia has features that include the provision of automated calculation for VAT, which is an important element needed for accurate tax computations among the businesses. VAT in Saudi Arabia has been implemented in recent years and like any other countries, there are changes in the rates and rules as well. Gaining advanced ERP system the business can obtain the determination of the exact value added tax for any type of transaction. This minimizes the risks of human interference and ensures that all the businesses are implementing the current tax laws on the VAT rates provided by the ZATCA. Using real time updates on their ERP system, your business is ever ready for audits and tax filings without any likelihood of having different figures from those stated on the business returns.

2. Seamless Integration with ZATCA Systems

Another key factor is the process of harmonisation of VAT compliance in Saudi Arabia with the use of ZATCA’s e-invoicing solution. The best ERP system in Saudi Arabia is linked with ZATCA’s platform to produce and produce electronic invoices in the right format. This has the advantage of avoiding the submission process which, apart from taking time, has the potential of bringing compliance issues. Thus, with the help of ERP system, the invoices of your business are properly formatted and submitted that will lessen the burden of non-compliance with ZATCA’s stringent e-invoicing rules.

3. Real-Time Tax Filing and Audits

Another benefit that comes with the use of the best ERP system in Saudi Arabia is its capacity on easing the filing and audits of VAT. These reports are real-time and help business track their VAT obligation without having to wait for a certain fiscal period to elapse. At the time of preparing the VAT returns, the data required is obtained from the ERP system and the reports generated are in accordance with the ZATCA standards. This is due to the fact that it helps avoid situations where the laid down deadlines are not met or correct tax returns filed in an organization are prepared and submitted which may lead to penalties and audits. The fact that these operations are addressed by ERP systems frees businesses from worrying about any possible future tax-related questions they might face.

4. Document Management and Archiving

It is mandatory for companies in ZATCA to maintain records of the invoices, receipts, and tax returns for some years. The best ERP system in Saudi Arabia is as advantageous in this regard because it provides a reliable document management system. This feature enables archiving of all documents in a manner that adheres to the laid down archiving policy of ZATCA. Auditing of records is made easier and fast since business can easily produce them when required hence cutting out much time and energy in record keeping and at the same time they will be fully compliant without having to deal with cases of loss of records.

5. Customizable Compliance Features

Every business organization is special in its own respect, therefore the need for taxes also differ. The most suitable ERP system in Saudi Arabia is one that can be easily adapted to your business and its nature. This means that no matter whether your company is in retail, manufacturing, or services, you can have the specific VAT that is applicable on the system. By so doing, the business entities shall be in a position to meet the changes in the ZATCA’s laws on VAT as well as enhance efficiency in their operations.

6. Real-Time Tax Analytics

One of the most important factors that defines the best ERP system in Saudi Arabia is the system’s analytics. The system makes it easy for the business organizations to real-time monitoring of their tax liability and fiscal stability. In this paper, the authors know the importance of using tax data to understand the trends that affect businesses and set right taxes to be paid. This way, they are not only VAT compliant but are equally ready for finance challenges since they are prepared to meet any VAT compliance issues.

Conclusion

Therefore, the two taxes, namely, Value Added Tax and Zakat, Tax, Collection, and Audit are not only a legal requirement for companies that operate in KSA but are also vital for the business’s sustainable growth and success. The most suitable ERP system in Saudi Arabia includes features that include taxation solutions, reporting, and integration with current ZATCA electronic invoice. They make the compliance process less of a burden, decreases the probability of fines, and enhance the financial process of an organization.

With a right ERP system in place that follows the countries legal requirement, companies can be able to avoid constant changes in the tax laws and policies and hence focus on what they do best. In sum, the right choice of the ERP system empowers businesses in Saudi Arabia with efficient financial performance and steady compliance along with future sustainability.

Written By:

Aya Basha

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.