Life Insurance: A Smart Investment for Your Family’s Future

John Robinson

27 Feb, 2025

6 mins read

39

John Robinson

27 Feb, 2025

6 mins read

39

Life is full of uncertainties, and ensuring your family’s financial security is one of the most responsible decisions you can make. Life insurance is more than just a policy; it’s a safeguard against financial hardships that may arise in your absence. Understanding the different types of life insurance and their benefits can help you choose the best option tailored to your needs.

Understanding Life Insurance

Life insurance is a financial agreement between you and an insurance provider. You pay regular premiums, and in return, your beneficiaries receive a lump-sum payout in case of your passing. This ensures your loved ones are not burdened with financial struggles, helping them cover daily expenses, debts, and future investments.

Key Benefits of Life Insurance

- Protects Your Loved Ones

- Life insurance provides a financial cushion to your dependents, ensuring their well-being even after you're gone.

- Pays Off Debts and Loans

- Outstanding mortgages, car loans, and personal debts can be managed through the death benefit, preventing financial strain on your family.

- Income Replacement

- Your family’s standard of living can be maintained by replacing lost income through a life insurance payout.

- Covers Funeral and Medical Expenses

- Life insurance helps ease the financial burden of final expenses, including funeral costs and unpaid medical bills.

- Long-Term Wealth Planning

- Permanent life insurance policies, such as whole or universal life insurance, allow policyholders to build cash value that can be accessed during their lifetime.

Types of Life Insurance Policies

- Term Life Insurance

- Affordable coverage for a specific duration (10, 20, or 30 years).

- Ideal for temporary financial protection needs.

- Whole Life Insurance

- Provides lifetime coverage with a cash savings component.

- Premiums remain stable throughout the policyholder’s life.

- Universal Life Insurance

- Offers flexible premiums and investment options.

- Accumulates cash value with potential growth.

- Variable Life Insurance

- Includes investment opportunities with market-driven returns.

- Riskier but offers greater potential financial benefits.

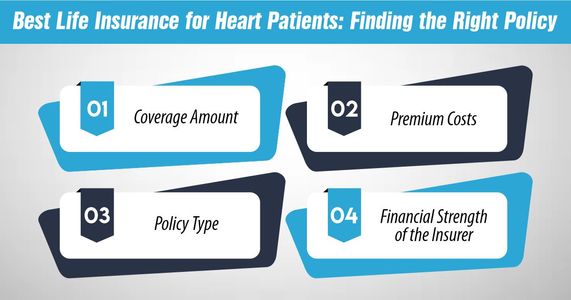

How to Select the Right Life Insurance Policy

Choosing the right life insurance plan depends on factors such as:

- Your financial goals and family needs.

- Your budget and affordability.

- Desired policy duration and coverage amount.

- Health status and lifestyle habits.

- Investment preferences for cash value policies.

Debunking Common Life Insurance Myths

- “I’m too young for life insurance.â€

- Purchasing life insurance at a younger age secures lower premiums and comprehensive coverage.

- “My employer’s life insurance is enough.â€

- Employer-provided policies often have limited coverage, making a personal policy necessary for full financial security.

- “Life insurance is too expensive.â€

- Term life insurance offers affordable protection, making coverage accessible for individuals at any income level.

Secure Your Future with M-Life Insurance

We understand the importance of safeguarding your family’s future. Our team is dedicated to helping you find the perfect life insurance plan that aligns with your financial goals. Visit us at M-Life Insurance to explore personalized insurance options.

Don’t wait to protect your loved ones! Contact M-Life Insurance today for a free consultation and secure the peace of mind you deserve.

By investing in life insurance now, you can ensure your family remains financially secure, no matter what the future holds.

Written By:

John Robinson

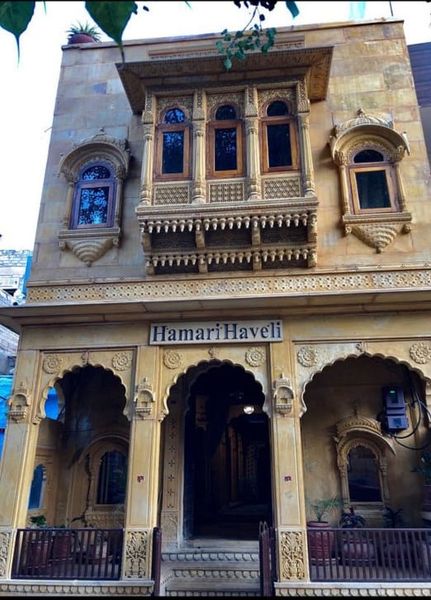

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.