Philippines E-Commerce Market Size, Trends & Opportunity Analysis 2025-2033

Arlo Bennett

31 Oct, 2025

15 mins read

44

Arlo Bennett

31 Oct, 2025

15 mins read

44

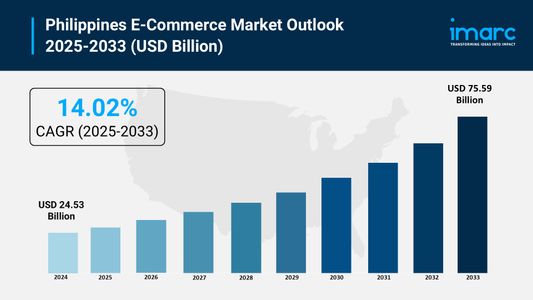

The latest report by IMARC Group, "Philippines E-Commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and Region, 2025-2033," provides an in-depth analysis of the Philippines E-Commerce Market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines E-Commerce Market size reached USD 24.53 Billion in 2024 and is projected to grow to USD 75.59 Billion by 2033, exhibiting a robust growth rate of 14.02% during the forecast period.

Report Attributes and Key Statistics:

- Base Year: 2024

- Forecast Years: 2025-2033

- Historical Years: 2019-2024

- Market Size in 2024: USD 24.53 Billion

- Market Forecast in 2033: USD 75.59 Billion

- Growth Rate (2025-2033): 14.02%

Philippines E-Commerce Market Overview:

The Philippines E-Commerce Market is experiencing transformative growth driven by expanding retail channels, rising digital payment adoption with mobile wallets exceeding 65% penetration in 2024, and mobile commerce revolution with smartphone household penetration reaching 80%. World Bank approved USD 750 million second digital transformation development policy loan in November 2024 improving trust in e-commerce and building advanced payment infrastructure. Technology integration including AI-powered recommendation engines, encryption, two-factor authentication, and biometric verification in digital payment services lowering fraud risk. Social commerce through Facebook and TikTok live selling events, influencer marketing, and provincial logistics mini-hubs shortening delivery routes across 7,641 islands positioning e-commerce as critical retail channel supporting digital transformation.

Request For Sample Report: https://www.imarcgroup.com/philippines-e-commerce-market/requestsample

Philippines E-Commerce Market Trends:

Philippines E-Commerce Market trends include mobile commerce becoming dominant force driven by nation's young tech-embracing population with over 89 million users relying predominantly on smartphones for internet access. Social commerce revolutionizing sales through Facebook and TikTok live selling events, influencer marketing, and viral content with over 3.2 million Android app downloads for TikTok Shop demonstrating platform popularity. Digital wallet adoption experiencing unprecedented growth with GCash amassing 94 million users by early 2025, Maya widening wallet with credit extensions, and digital payments reaching 52.8% of retail transaction volume. Buy-Now-Pay-Later credit expanding rapidly with providers white-labeling BNPL plugins merging credit scoring with wallet KYC data. Cross-border e-commerce flourishing under Regional Comprehensive Economic Partnership with tariff-free sourcing encouraging Filipino buyers accessing Japanese beauty items and Korean gadgets. AI-enhanced live-commerce tools raising conversion rates with OpenAI-powered scripts auto-generating product recommendations during Shopee live sessions and dynamic pricing bots adjusting offers real-time.

Philippines E-Commerce Market Drivers:

Philippines E-Commerce Market drivers include internet penetration increasing dramatically with over 85.16 million users and 73.6% penetration rate as of 2024 supporting digital shopping accessibility. Smartphone adoption reaching 80% household penetration with 78.82% of e-commerce sales generated through mobile devices facilitating mobile-first shopping behaviors. Government support through World Bank USD 750 million digital transformation loan, DTI merchant digitization programs accelerating SME onboarding, and April 2024 launch of Higala Inclusive Instant Payment System reducing real-time payment costs. Provincial logistics mini-hubs rollout shortening delivery routes across 7,641 islands with Central Visayas enjoying same-day delivery for high-velocity SKUs unlocking provincial demand. Rising disposable incomes with per capita retail spending around USD 60.3 in 2022 and expanding middle-class population driving retail spending. Social commerce integration with nearly half of online shoppers purchasing products seen on social media. 5G network expansion with Globe Telecom launching 256 new sites in first half 2024 providing faster internet speeds encouraging online shopping.

Market Challenges:

• Digital Divide limited internet connectivity in rural provinces with approximately 20% of population lacking reliable access constraining market penetration

• Cash-on-Delivery Preference COD still accounting for significant portion of orders indicating persistent preference for traditional payment methods affecting operational efficiency

• High Logistics Costs delivery fees remaining expensive particularly for remote islands deterring budget-conscious consumers from frequent purchases

• Product Quality Concerns consumer hesitation regarding authenticity and quality of items purchased online especially from cross-border sellers

• Platform Fee Increases Shopee and Lazada introducing PHP 5 order processing fee starting September 2025 adding burden to sellers already managing multiple fees

• Regulatory Compliance e-commerce complaints increasing 33% to 36,000 in 2024 requiring DTI adding 40 employees handling enforcement cases

• Tax Policy Debates Philippine Retailers Association urging government impose 12% VAT on physical goods sold via e-commerce platforms creating regulatory uncertainty

• Competition Intensity platform competition intensifying with Shopee, Lazada, TikTok Shop, and Temu competing aggressively affecting merchant profitability

Market Opportunities:

• Social Commerce Expansion leveraging Facebook, TikTok, and Instagram built-in features with live selling and influencer marketing projected reaching USD 569.2 million by 2029

• AI Integration implementing AI-powered recommendation engines, virtual try-ons, and augmented reality features offering 94% higher conversion rates

• Cross-Border Trade capitalizing on RCEP tariff-free sourcing connecting Filipino buyers with Japanese and Korean products supporting USD 240.5 billion export target by 2028

• Provincial Market Penetration establishing logistics mini-hubs in underserved regions with same-day delivery capabilities unlocking pent-up demand across 7,641 islands

• BNPL Services expanding Buy-Now-Pay-Later offerings merging credit scoring with digital wallet KYC data addressing payment flexibility needs

• Government Platform Initiatives supporting DTI Philippine e-Commerce Platform (PEP Store) launched July 2025 featuring 350 local merchants boosting MSME digitization

• Live Commerce Development implementing live-streaming shopping experiences with OpenAI-powered scripts and dynamic pricing bots enhancing customer engagement

• Digital Payment Innovation developing comprehensive fintech ecosystems including credit, savings, and insurance through platforms like GCash and Maya

Philippines E-Commerce Market Segmentation:

By Business Model:

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Consumer-to-Consumer (C2C)

By Mode of Payment:

- Digital Wallets

- GCash

- Maya

- ShopeePay

- Credit/Debit Cards

- Cash on Delivery

- Buy Now Pay Later (BNPL)

- Bank Transfers

By Service Type:

- Platform-to-Consumer

- Inventory-Based

- Marketplace

By Product Type:

- Consumer Electronics

- Fashion and Apparel

- Beauty and Personal Care

- Food and Beverages

- Home and Living

- Health and Wellness

- Books and Media

- Others

By Regional Distribution:

- Luzon

- Visayas

- Mindanao

Philippines E-Commerce Market News:

September 2025: Department of Transportation clarified fake news regarding alleged shutdown of major e-commerce platforms including Shopee, Lazada, Facebook Marketplace, Carousell, and TikTok. DTI only targeting unauthorized online resellers and hoarders of Beep cards spotted on platforms, not platforms themselves, demonstrating government regulatory focus on consumer protection while supporting legitimate e-commerce growth.

August 2025: Shopee and Lazada announced introduction of PHP 5 order processing fee starting September 3, 2025, applicable to each successfully completed order regardless of order value. New fixed fee will fund continued development and enhancement of platform infrastructure including order management, fulfillment, visibility features, and seller tools. Online sellers aired complaints tagging DTI in Facebook forums over surprise fee adding to VAT and transaction fees already charged.

July 2025: Department of Trade and Industry launched Philippine e-Commerce Platform (PEP Store) featuring 350 domestic brands balancing import influx and linking local MSMEs to overseas consumers. Initiative aims boost MSME digitization supporting government's five-point strategy emphasizing digitalization and AI improving competitiveness as part of Philippine Export Development Plan 2023-2028 targeting USD 240.5 billion exports by 2028.

May 2025: AnyMind Group attained partner certifications for TikTok Shop, Shopee, and Lazada across Southeast Asian markets including Philippines. Company certified as TikTok Shop Partner in Philippines, Malaysia, Vietnam, and Indonesia, while also becoming Shopee Certified Enabler and Lazada Certified Enabler. Certifications validate technology and team capabilities providing more efficient management and cross-channel data analysis through proprietary platforms.

Key Highlights of the Report:

- Market analysis projecting exceptional growth from USD 24.53 billion (2024) to USD 75.59 billion (2033) with 14.02% CAGR

- World Bank approving USD 750 million second digital transformation development policy loan in November 2024 improving e-commerce infrastructure

- Mobile commerce dominating with 78.82% of sales generated through smartphones and 80% household penetration rate

- Digital wallet adoption exceeding 65% penetration in 2024 with GCash reaching 94 million users by early 2025

- Social commerce revenue projected reaching USD 569.2 million by 2029 with Facebook and TikTok driving interactive shopping

- DTI launching Philippine e-Commerce Platform (PEP Store) in July 2025 featuring 350 local merchants boosting MSME digitization

- Provincial logistics mini-hubs shortening delivery routes across 7,641 islands with Central Visayas enjoying same-day delivery

- Business-to-Consumer transactions capturing 92.12% of market share in 2024 with B2B projected expanding at 15.13% CAGR

- Consumer electronics holding 28.25% of 2024 revenue while food and beverages growing fastest at 14.67% CAGR

- Regional Comprehensive Economic Partnership enabling tariff-free cross-border sourcing supporting USD 240.5 billion export target by 2028

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines E-Commerce Market growth to USD 75.59 billion by 2033?

A1: Market driven by internet penetration reaching 85.16 million users with 73.6% penetration rate, smartphone adoption achieving 80% household penetration with 78.82% of sales generated through mobile devices, and digital wallet adoption exceeding 65% with GCash reaching 94 million users by early 2025. Government support through World Bank USD 750 million digital transformation loan, DTI merchant digitization programs, and Higala Inclusive Instant Payment System launched April 2024 reducing payment costs contribute to 14.02% growth rate. Provincial logistics mini-hubs shortening delivery routes, 5G network expansion, and social commerce integration support market expansion.

Q2: How is social commerce transforming the Philippines e-commerce landscape?

A2: Social commerce revolutionizing market through Facebook and TikTok live selling events, influencer marketing, and viral content with TikTok Shop achieving over 3.2 million Android app downloads demonstrating platform popularity. Nearly half of online shoppers purchased products seen on social media in past three months with social commerce revenue projected reaching USD 569.2 million by 2029. Platforms integrating AI-enhanced live-commerce tools with OpenAI-powered scripts auto-generating product recommendations and dynamic pricing bots adjusting offers real-time. DTI collaborating with TikTok strengthening ties advancing innovative economy positioning entertainment-centric retail formats and interactive shopping experiences as key competitive advantages.

Q3: What opportunities exist for e-commerce stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on social commerce expansion leveraging Facebook, TikTok, and Instagram built-in features with live selling projected reaching USD 569.2 million by 2029, AI integration implementing recommendation engines and augmented reality offering 94% higher conversion rates, and cross-border trade capitalizing on RCEP tariff-free sourcing supporting USD 240.5 billion export target by 2028. Provincial market penetration establishing logistics mini-hubs with same-day delivery, BNPL services expanding payment flexibility, and government platform initiatives supporting DTI PEP Store launched July 2025 represent opportunities. Live commerce development with OpenAI-powered scripts, digital payment innovation developing comprehensive fintech ecosystems, and enterprise solutions targeting businesses requiring digital transformation support market growth diversification meeting increasing consumer demands across mobile-first population.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28734&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

Written By:

Arlo Bennett

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.