Ride Without Worries: How Two-Wheeler Insurance Online Makes Your Travel Safer

Square Insurance

13 Aug, 2025

10 mins read

11

Square Insurance

13 Aug, 2025

10 mins read

11

Introduction

Whether you are planning a weekend road trip to the hills or commuting daily through bustling city streets, riding a two-wheeler offers unmatched freedom and convenience. However, that freedom also comes with risks  from unexpected accidents to theft and natural calamities. That's where two-wheeler insurance online steps in as your reliable travel companion, offering protection, peace of mind, and convenience at your fingertips.

In this guide, we’ll explore why having online two-wheeler insurance is crucial for safe travel, the benefits it brings, and how you can make the most of it.

1. Why Two-Wheeler Insurance is Essential for Travel Safety

Travelling without valid bike insurance isn’t just risky  it’s illegal in India. The Motor Vehicles Act mandates that all two-wheelers must have at least third-party insurance. Beyond the legal requirement, a comprehensive plan ensures that you’re financially protected against:

- Accidents and Collisions – Covers repair costs or replacement in case of damage.

- Third-Party Liabilities – Compensates for damages or injuries caused to another person or property.

- Theft or Natural Disasters – Offers reimbursement if your bike is stolen or damaged due to floods, earthquakes, etc.

- Medical Expenses – Helps cover treatment costs in case of injuries.

When you’re travelling, especially over long distances, these protections become even more important.

2. Why Buy Two-Wheeler Insurance Online Instead of Offline

The traditional way of buying or renewing bike insurance meant visiting agents, filling paperwork, and waiting days for policy issuance. With two-wheeler insurance online, you can complete the process in minutes. Key advantages include:

a. Instant Policy Issuance

Once you make the payment, the policy document is emailed instantly. This is ideal for last-minute travel plans.

b. Easy Comparison

Online platforms allow you to compare coverage, benefits, premiums, and claim settlement ratios across multiple insurers before making a choice.

c. No Middlemen

You deal directly with the insurer, eliminating commission costs and ensuring transparency.

d. 24/7 Availability

You can buy or renew insurance anytime, even late at night before an early morning ride.

3. How Online Two-Wheeler Insurance Makes Travel Safer

a. Real-Time Support

Most insurers now offer app-based services, including GPS-enabled emergency assistance, making it easier to get help during breakdowns or accidents.

b. Cashless Garage Network

If your bike needs repairs during travel, cashless garages in the insurer’s network will handle billing directly, reducing stress and financial strain.

c. Quick Claim Settlement

Digital claim processes speed up approvals, ensuring you can get back on the road faster.

d. Add-On Covers for Travellers

Options like roadside assistance, zero depreciation, and personal accident cover for pillion riders enhance your travel safety.

4. Step-by-Step Guide to Buying Two-Wheeler Insurance Online for Safe Travel

If you’re planning a trip, here’s how to get your insurance sorted quickly:

- Visit a Reputed Insurance Website – Choose a trusted provider or aggregator.

- Enter Bike Details – Registration number, make, model, and manufacturing year.

- Select Coverage Type – Third-party or comprehensive (recommended for travellers).

- Choose Add-Ons – Roadside assistance, engine protection, etc.

- Review and Compare – Check prices, features, and claim settlement history.

- Make Payment – Use secure online payment options.

- Download Policy – Keep a digital copy on your phone and a printed copy while travelling.

5. Add-On Covers That Are Worth It for Travel Safety

- Roadside Assistance – Essential for breakdowns in remote areas.

- Personal Accident Cover for Pillion Riders – Protects your co-travellers.

- Engine Protection Cover – Useful if travelling in flood-prone areas.

- Zero Depreciation Cover – Ensures maximum claim amount without deductions.

- Consumables Cover – Includes costs for oils, nuts, bolts, etc., during repairs.

6. Common Mistakes to Avoid When Buying Two-Wheeler Insurance Online

- Opting for the Cheapest Plan Only – Low premiums might mean minimal coverage.

- Skipping Add-Ons – Some add-ons can be lifesavers during travel.

- Not Reading Terms and Conditions – Understand exclusions before buying.

- Ignoring Renewal Reminders – Lapsed policies can lead to penalties and no coverage.

- Providing Incorrect Information – Could lead to claim rejections later.

7. Tips to Maximise Travel Safety with Online Insurance

- Save Emergency Contacts – Have your insurer’s helpline stored in your phone.

- Know the Cashless Garage Network – Identify garages along your travel route.

- Keep Both Digital and Physical Copies of Policy – For police checks or emergencies.

- Update Your Policy Details – Ensure contact number, address, and nominee information are current.

- Renew Early – Avoid last-minute rushes before travel.

8. Why Travellers Prefer Two-Wheeler Insurance Online in 2025

The growing popularity of two-wheeler insurance online among travellers can be attributed to:

- The rise of solo and group bike trips in India.

- Digital literacy making online transactions safer and faster.

- The availability of customisable policies with travel-specific add-ons.

- Paperless and eco-friendly policy issuance.

Conclusion

Travelling by bike gives you an unmatched sense of freedom  but it also exposes you to risks that can turn an exciting trip into a financial nightmare. By opting for two-wheeler insurance online, you not only comply with the law but also ensure that you have reliable protection no matter where the road takes you.

With instant policy issuance, easy comparisons, and travel-friendly add-ons, online insurance is the smartest choice for today’s riders. Before your next trip, gear up, wear your helmet, and secure your journey with the right insurance plan  because riding without worries is the best way to explore.

window.NREUM||(NREUM={});NREUM.info={"beacon":"bam.nr-data.net","licenseKey":"NRJS-3109bb2e2783f515265","applicationID":"558315209","transactionName":"blUHbEVQCxECBUVQWVcfMEpeHhARBhRCFlRVXwIXVEMAAxcDU1VZXh4VUEc=","queueTime":0,"applicationTime":146,"atts":"QhIEGg1KGB8=","errorBeacon":"bam.nr-data.net","agent":""}

Written By:

Square Insurance

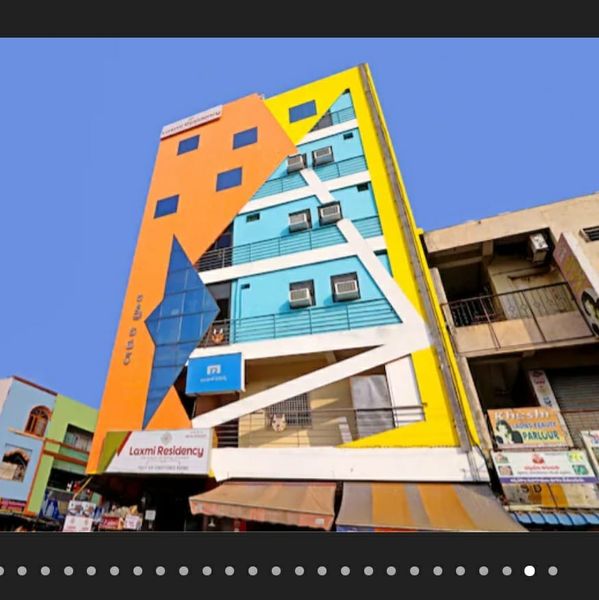

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.