Smart Beacon Market – Growth, Trends, and Opportunities

Hub Marketing

01 Sep, 2025

9 mins read

30

Hub Marketing

01 Sep, 2025

9 mins read

30

Smart beacons, small Bluetooth Low Energy (BLE) transmitters used for indoor positioning, proximity marketing, RTLS, and context-aware apps, are moving from pilots to scaled deployments in retail, healthcare, logistics, and smart venues. Recent estimates put the broader beacon market in the low-to-mid single-digit billions today with strong double-digit CAGRs through 2030, driven by location-based services, analytics, and smart-facility use cases.

A key technology catalyst is Bluetooth 5.4, which introduced Periodic Advertising with Responses (PAwR) and Encrypted Advertising Data (EAD). PAwR enables ultra-low-power, many-to-many, bidirectional communication, ideal for large fleets of beacons and tags in stores, hospitals, and factories.

Request a Sample Report@ https://straitsresearch.com/report/smart-beacon-market/request-sample

Restraints

- Privacy & compliance risk: proximity data collection raises regulatory scrutiny (consent, purpose limitation).

- Signal reliability indoors: multipath, crowds, and device variability can impact accuracy and require careful RF design and calibration.

- Fragmented ecosystem: multiple beacon formats (iBeacon, Eddystone), mixed device support, and a long tail of vendors complicate scale-ups.

- Capex & ops burden: large estates need lifecycle tools for provisioning, battery swaps, and firmware, otherwise TCO creeps.

Opportunities

- Healthcare RTLS & safety: staff duress, asset tracking, patient flow, and temperature monitoring are scaling fast, supported by managed RTLS platforms and AI analytics.

- Retail media & hyper-personalization: beacons plus PAwR enable real-time engagement, wayfinding, and closed-loop attribution in stores.

- Smart facilities: occupancy analytics, workflow automation, and energy optimization across offices, airports, stadiums and campuses, often piggybacking on Wi-Fi APs with integrated BLE.

- Logistics & cold chain: BLE tags with gateway backhaul for zone-level location, condition monitoring, and automated audit trails.

Segments in short

By Type

- BLE beacons (dominant), Hybrid (BLE+Wi-Fi/UWB/NFC depending on use case).

By Application

- Retail, Public venues & events, Hospitality, Transportation & logistics, Aviation, Healthcare, Sports, Others.

By End User / Deployment

- Enterprises & campuses, Healthcare providers, Retailers & malls, Airports & stadiums, Smart cities/municipal spaces (often via systems integrators and network OEMs).

Key Players with latest reported revenues

(Revenues shown are the latest available company-level figures; beacon revenue is a subset.)

(A) Cisco Systems, Inc. , FY2024 revenue US$53.8B; Cisco provides BLE-enabled networking and location services used in enterprise deployments.

(B) HPE Aruba Networking (Hewlett Packard Enterprise) , FY2024 HPE revenue US$30.1B; Aruba sells standalone beacons and BLE-enabled APs powering indoor location/wayfinding.

Additional notable vendors across hardware, platforms, and RTLS: HID Global (ASSA ABLOY) , 2024 group sales ~SEK 150B (HID parent); Kontakt.io (RTLS/IoT PaaS); Gimbal/inMarket, Sensoro, Beaconstac, Radius Networks, Estimote, BlueCats/BlueUp, Leantegra, Zebra Technologies (BLE tags/gateways; 2024 revenue US$4.98B).

Why show parent revenue? Many beacon leaders are divisions of larger public companies; parent figures are the most transparent audited numbers available.

Latest Developments & Collaborations

- Spec evolution enabling scale: Bluetooth 5.4 PAwR + EAD strengthen low-power bidirectional comms and privacy for large beacon/tag networks.

- Healthcare momentum: Kontakt.io launched mobile RTLS apps for staff duress and asset tracking and expanded staff-safety coverage outdoors.

- Ecosystem partnerships: Singlewire Software partnered with Kontakt.io to combine incident management and wearable panic buttons for hospitals.

- Network-integrated location: HPE Aruba continues to embed location services into Wi-Fi APs and management platforms, simplifying beacon rollouts at enterprise scale.

Purchase the Full Report@ https://straitsresearch.com/buy-now/smart-beacon-market

FAQs

Q1. What’s the difference between smart beacons and classic beacons?

Smart beacons pair BLE broadcasting with management, telemetry, and integrations (SDKs, cloud APIs, security features like EAD), enabling analytics and automation beyond simple one-way “push.â€

Q2. Where is demand strongest right now?

Healthcare RTLS/safety, retail media & wayfinding, and smart workplaces/venues, often integrated via Wi-Fi-with-BLE networks.

Q3. Which spec features matter for 2025+ deployments?

Bluetooth 5.4 PAwR (for dense fleets) and EAD (encrypted advertising) materially improve scalability and privacy.

Q4. Who are some credible vendors to evaluate?

Cisco, HPE Aruba (infrastructure & location), HID Global (via Bluvision heritage), Zebra (BLE tags), Kontakt.io (RTLS platform), plus specialists like Estimote, Sensoro, Beaconstac, and Radius Networks.

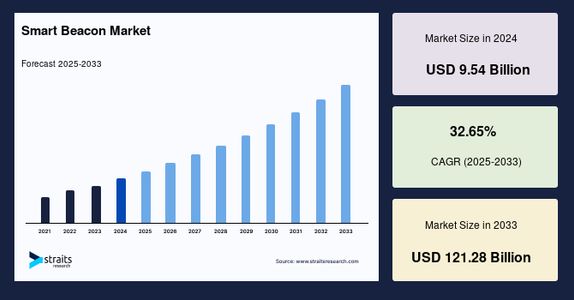

Q5. How big is the market and growth outlook?

Recent analyses place the market from low billions today with robust double-digit CAGR through 2030, with some forecasts projecting mid-to-high single-digit billions by 2030 as deployments scale.

Conclusion

The smart beacon market is transitioning from pilots to platform-level deployments, pulled by healthcare safety/RTLS, retail media, and smart-facility analytics. The arrival of Bluetooth 5.4 (PAwR/EAD) removes key scalability and privacy hurdles, while network OEMs (e.g., HPE Aruba, Cisco) lower integration friction by baking BLE into Wi-Fi infrastructure. For buyers, the playbook is clear: start with the use case (safety, flow, media, or asset visibility), choose vendors with fleet management and security baked in, and design for operations (battery lifecycle, remote updates) from day one. With these foundations, proximity-aware experiences and indoor intelligence can be delivered reliably and at scale.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Written By:

Hub Marketing

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.