Super Visa Insurance Monthly Plan: The Ideal Choice for Parents and Grandparents Visiting Canada

Rahul Das

24 Nov, 2024

16 mins read

92

Rahul Das

24 Nov, 2024

16 mins read

92

As a Canadian citizen or permanent resident, bringing your parents or grandparents to visit is a wonderful opportunity to reconnect. However, obtaining a Super Visa is not as simple as just submitting an application—there are specific requirements, and one of the most important is having the right insurance coverage. The Super Visa insurance monthly plan is an affordable way to meet these requirements while ensuring your loved ones are fully protected during their stay in Canada. In this article, we’ll explore everything you need to know about this plan, from how it works to the benefits it offers and why it’s an ideal choice for families looking to bring their parents or grandparents to Canada.

What is a Super Visa Insurance Monthly Plan?

When applying for a Super Visa to visit Canada, one of the mandatory requirements is to show proof of valid medical insurance coverage. This insurance must cover emergency medical expenses, hospitalization, and repatriation costs for the entire duration of the applicant’s stay. The Super Visa insurance monthly plan is a flexible option that allows you to pay your insurance premiums on a monthly basis, making it a budget-friendly alternative to upfront, lump-sum payments.

A Super Visa insurance monthly plan can be particularly appealing for individuals who want to avoid the burden of paying for the entire insurance premium upfront. Instead, this plan allows you to manage payments in smaller, more manageable installments while still ensuring your loved ones are covered with comprehensive medical insurance. In addition, these plans are offered by Canadian insurance providers, ensuring they meet the strict government requirements for Super Visa holders.

Why Choose a Super Visa Insurance Monthly Plan?

Choosing the right insurance for your loved ones is essential, and there are several reasons why the Super Visa insurance monthly plan is an ideal option for many families. Here are some key benefits:

1. Flexibility in Payment

One of the main advantages of the Super Visa insurance monthly plan is the flexibility it offers in terms of payments. Instead of paying a large lump sum upfront, you can spread out the cost of your insurance over several months. This option makes it easier to budget for the insurance without impacting your finances too much, especially if you're covering multiple family members.

2. Affordable Coverage

With a Super Visa insurance monthly plan, you get affordable coverage that meets the Canadian government’s minimum requirements. These plans typically cover emergency medical expenses, hospitalization, and repatriation, which ensures that your parents or grandparents are protected in case of any health issues during their visit to Canada. Although the premiums are paid monthly, the coverage is just as comprehensive as plans with annual payments.

3. Simplified Renewal Process

Many Super Visa insurance monthly plans offer the convenience of automatic renewal. This means that as long as you continue to make payments on time, your insurance coverage will automatically renew without requiring you to reapply. This simplifies the process for families who want to ensure continuous coverage for their loved ones without worrying about missing deadlines or reapplying for new insurance.

4. Customizable Plans

Not all families have the same needs when it comes to insurance coverage. The Super Visa insurance monthly plan offers a variety of coverage options, allowing you to select the level of protection that best fits your situation. Whether you're looking for basic emergency medical coverage or a more comprehensive plan that includes additional benefits like trip cancellation or lost baggage coverage, there are options available to suit different needs.

5. Easy Access to Trusted Providers

Canada has a number of insurance companies that specialize in Super Visa insurance, and a Super Visa insurance monthly plan gives you access to these trusted providers. These companies are well-versed in the requirements set by the Canadian government, ensuring that the plan you choose meets all necessary standards. Working with a reliable provider also ensures that you have access to a customer support team that can assist with any questions or claims.

How Does the Super Visa Insurance Monthly Plan Work?

A Super Visa insurance monthly plan functions just like a regular insurance policy, but with the added benefit of monthly premium payments. The plan is designed to meet the Canadian government's requirements for Super Visa applicants and typically covers emergency medical care, hospitalization, and repatriation.

Step 1: Choose Your Coverage

The first step is to choose the type of coverage you need. A Super Visa insurance monthly plan can cover a wide range of medical expenses, from emergency doctor visits to hospital stays and surgeries. Additionally, some plans may offer coverage for additional services like prescription medications, ambulance transportation, or even evacuation in case of a serious emergency.

Step 2: Select the Payment Schedule

Once you’ve chosen the right coverage, the next step is to decide how much you want to pay each month. Insurance companies often offer a variety of options, so you can find a payment schedule that works best for your family’s budget. Depending on the insurance provider, you may be able to adjust the monthly premium amount or make additional payments if needed.

Step 3: Make Monthly Payments

Once your Super Visa insurance monthly plan is in place, you’ll start making monthly payments. These payments are typically deducted automatically from your bank account, which makes it easy to stay on top of your premiums without worrying about missing a payment. It’s important to make sure that payments are made on time to avoid a lapse in coverage.

Step 4: Utilize Coverage When Needed

In the event of an emergency, your loved one can access the benefits of the Super Visa insurance monthly plan. If they require medical treatment, the insurance will cover the necessary expenses up to the limits outlined in the policy. Be sure to keep a copy of the policy and the insurer’s contact details handy in case you need to make a claim.

Factors to Consider When Choosing a Super Visa Insurance Monthly Plan

While the Super Visa insurance monthly plan offers flexibility and affordability, it’s important to carefully consider all factors when choosing the right plan for your family members. Here are some key factors to keep in mind:

1. Coverage Limits and Exclusions

Before committing to a plan, carefully review the coverage limits and any exclusions that may apply. While the Super Visa insurance monthly plan will typically cover emergency medical expenses, there may be certain situations or treatments that are not included. Ensure that the plan you choose covers the full range of medical services your family member might need.

2. Pre-existing Conditions

If your parents or grandparents have pre-existing medical conditions, it’s important to check if the Super Visa insurance monthly plan covers these conditions. Some policies may exclude coverage for pre-existing health issues, while others may offer limited protection. Be sure to read the fine print and check with the insurance provider about any exclusions related to pre-existing conditions.

3. Provider Reputation

Not all insurance providers are the same. It’s important to choose a provider with a strong reputation for customer service and reliable claims handling. Look for reviews and testimonials from other Super Visa holders to ensure you are choosing a provider that will offer support when needed.

4. Additional Benefits

Some Super Visa insurance monthly plans may offer additional benefits, such as trip cancellation coverage, lost luggage insurance, or emergency evacuation. These extra benefits can provide added peace of mind, especially if your parents or grandparents are traveling long distances to visit you in Canada.

FAQ:

1. How much does a Super Visa insurance monthly plan cost?

The cost of a Super Visa insurance monthly plan varies depending on factors such as the age of the applicant, the level of coverage, and the insurance provider. On average, you can expect to pay between $100 and $250 per month.

2. Can I pay for Super Visa insurance in a lump sum instead of monthly payments?

Yes, most insurance providers offer the option to pay for Super Visa insurance in a lump sum. However, the Super Visa insurance monthly plan is designed to provide more flexibility by allowing you to spread out the cost over time.

3. Does the Super Visa insurance monthly plan cover pre-existing conditions?

Coverage for pre-existing conditions varies by provider and plan. Some policies offer limited coverage for pre-existing conditions, while others may exclude them altogether. Be sure to read the policy details and check with the provider to confirm coverage.

4. What happens if I miss a monthly payment?

If you miss a payment, your coverage may be suspended or canceled. To avoid this, most providers offer automatic payment options to ensure timely payments and continuous coverage.

5. Can I extend my Super Visa insurance monthly plan if my family member stays longer?

Yes, many insurance providers allow you to extend your coverage if your family member’s stay in Canada is extended. Be sure to contact your insurer well before the policy expires to arrange for an extension.

Conclusion

A Super Visa insurance monthly plan is an excellent choice for families looking to bring their parents or grandparents to Canada while ensuring they have access to affordable and comprehensive medical coverage. With flexible payment options, customizable coverage, and the convenience of automatic renewal, this plan provides the peace of mind you need for your loved ones’ stay in Canada.

For more information on the Super Visa insurance monthly plan, visit this link to find the best options for your family. By choosing the right plan, you can rest assured that your parents or grandparents will have the protection they need while enjoying their time in Canada.

Written By:

Rahul Das

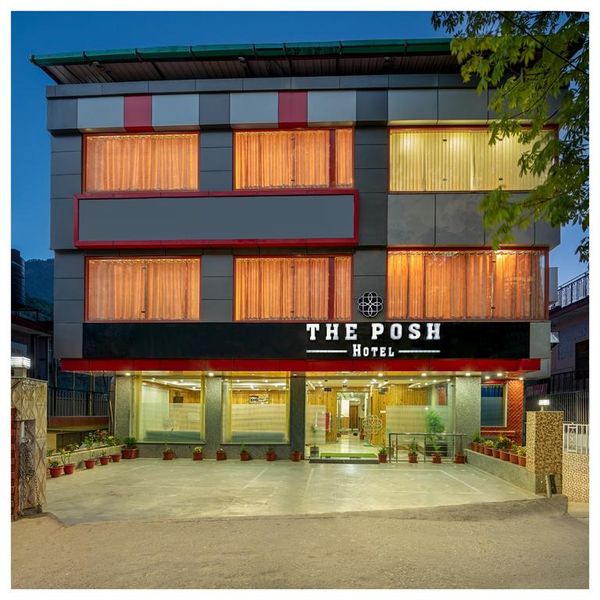

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.