Top Insights from the Best IUL Books of the Year

Steve Curren

30 May, 2025

7 mins read

33

Steve Curren

30 May, 2025

7 mins read

33

The best IUL books of the year offer in-depth, accessible insights into how Indexed Universal Life (IUL) insurance can serve as a versatile financial tool, combining life insurance protection with tax-advantaged wealth accumulation strategies.

Unlocking the Potential of IUL Through Literature

In the evolving landscape of financial planning, Indexed Universal Life (IUL) insurance has emerged as a compelling option for those seeking both protection and growth. The best IUL books provide readers with a comprehensive understanding of how these policies function, demystifying complex concepts and illustrating practical applications. By exploring these resources, individuals can gain the knowledge necessary to make informed decisions about incorporating IUL into their financial strategies.

These books delve into the mechanics of IUL, offering insights into premium structures, interest crediting methods, and the nuances of policy loans. They also address common misconceptions and highlight the potential benefits and risks associated with IUL policies. Through real-life examples and expert analyses, readers are equipped to evaluate whether IUL aligns with their financial goals.

Understanding the Fundamentals of Indexed Universal Life Insurance

Indexed Universal Life insurance is a type of permanent life insurance that offers a death benefit along with a cash value component. The cash value grows based on the performance of a selected stock market index, such as the S&P 500, but with a guaranteed minimum interest rate to protect against market downturns. This structure allows policyholders to participate in market gains while mitigating losses.

One of the key features of IUL is its flexibility. Policyholders can adjust premium payments and death benefits to accommodate changing financial circumstances. Additionally, the cash value can be accessed through policy loans or withdrawals, providing a source of funds for various needs, such as education expenses or retirement income. However, it's important to understand the implications of these actions on the policy's performance and longevity.

Tax Advantages and Retirement Planning with IUL

A significant advantage of IUL policies is their favorable tax treatment. The cash value grows on a tax-deferred basis, and policy loans are generally tax-free, provided the policy remains in force. This feature makes IUL an attractive option for individuals seeking to supplement their retirement income while minimizing tax liabilities.

Moreover, the death benefit is typically paid out to beneficiaries tax-free, offering a means of transferring wealth efficiently. Some IUL books emphasize the use of these policies in estate planning, highlighting their role in preserving wealth across generations. By understanding the tax implications and strategic uses of IUL, individuals can better integrate these policies into their long-term financial plans.

Evaluating the Costs and Risks Associated with IUL

While IUL offers numerous benefits, it's essential to consider the associated costs and potential risks. Policy fees, including administrative charges and cost of insurance, can impact the cash value accumulation. Additionally, the cap rates and participation rates set by the insurer limit the extent to which the policy can benefit from market gains.

Market volatility can also affect the performance of the cash value component. Although IUL policies offer downside protection, prolonged periods of low interest crediting can hinder growth. Therefore, it's crucial for policyholders to regularly review their policies and adjust their strategies as needed. Comprehensive IUL books provide guidance on monitoring policy performance and making informed decisions to optimize outcomes.

Selecting the Right IUL Policy and Provider

Choosing an appropriate IUL policy requires careful consideration of various factors, including the insurer's financial strength, policy features, and cost structure. Reputable IUL books often include comparisons of different providers, highlighting the nuances in their offerings. This information assists readers in identifying policies that align with their financial objectives and risk tolerance.

It's also important to assess the flexibility of the policy, such as the ability to adjust premiums and death benefits, as well as the options for accessing the cash value. By thoroughly evaluating these aspects, individuals can select an IUL policy that supports their long-term financial goals.

The Role of Professional Guidance in IUL Planning

While IUL books serve as valuable educational resources, consulting with a financial advisor or insurance professional is advisable when considering an IUL policy. These experts can provide personalized analyses, taking into account individual financial situations and objectives. They can also assist in navigating the complexities of policy selection and management.

Professional guidance ensures that the chosen IUL policy complements other elements of a comprehensive financial plan. Advisors can help monitor policy performance, recommend adjustments, and address any concerns that arise over time. By combining the knowledge gained from IUL books with expert advice, individuals can make well-informed decisions to secure their financial futures.

Conclusion:

The best IUL books of the year provide readers with a thorough understanding of Indexed Universal Life insurance, elucidating its benefits, risks, and strategic applications. By exploring these resources, individuals are empowered to make informed decisions about incorporating IUL into their financial plans. While these books offer a solid foundation, seeking professional advice ensures that the chosen strategies align with personal financial goals and circumstances. Through education and expert guidance, IUL can serve as a powerful tool in achieving long-term financial security.

Written By:

Steve Curren

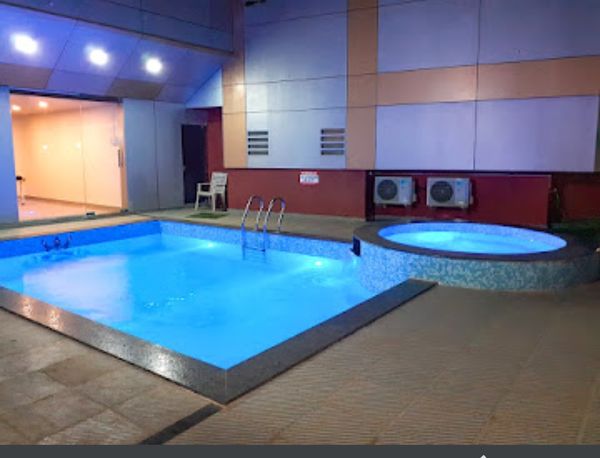

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.