Why the Best E-Invoicing Software is Essential for SMEs

Aya Basha

02 Apr, 2025

10 mins read

90

Aya Basha

02 Apr, 2025

10 mins read

90

The fast-paced competition in today's business world requires small and medium enterprises (SMEs) to find and adopt the most efficient financial solutions to remain in the race. One of the more powerfully effective tools for any modern business is simply the best e-invoicing software. The traditional paper-based invoicing system happens to be slow, often error-prone, and expensive on the overall. So with digital transformation, e-invoicing has become more of a necessity than an option. SMEs can streamline the billing process to minimize administrative work and comply with tax regulations through the use of e-invoicing software.

This operational speed provided by the best e-invoicing software greatly helps SMEs in the management of cash flow. The quicker invoices are processed and real-time tracking updates are given, the better cash flow management is achieved. Moreover, e-invoicing solves disputes that arise due to manual billing delays. With governments all over the world enforcing e-invoicing regulations, businesses are clamouring for a reliable solution to avoid penalties and establish compliance. Rightly chosen software can boost cash flow efficiency, enhance customer satisfaction, and lead to wider business growth.

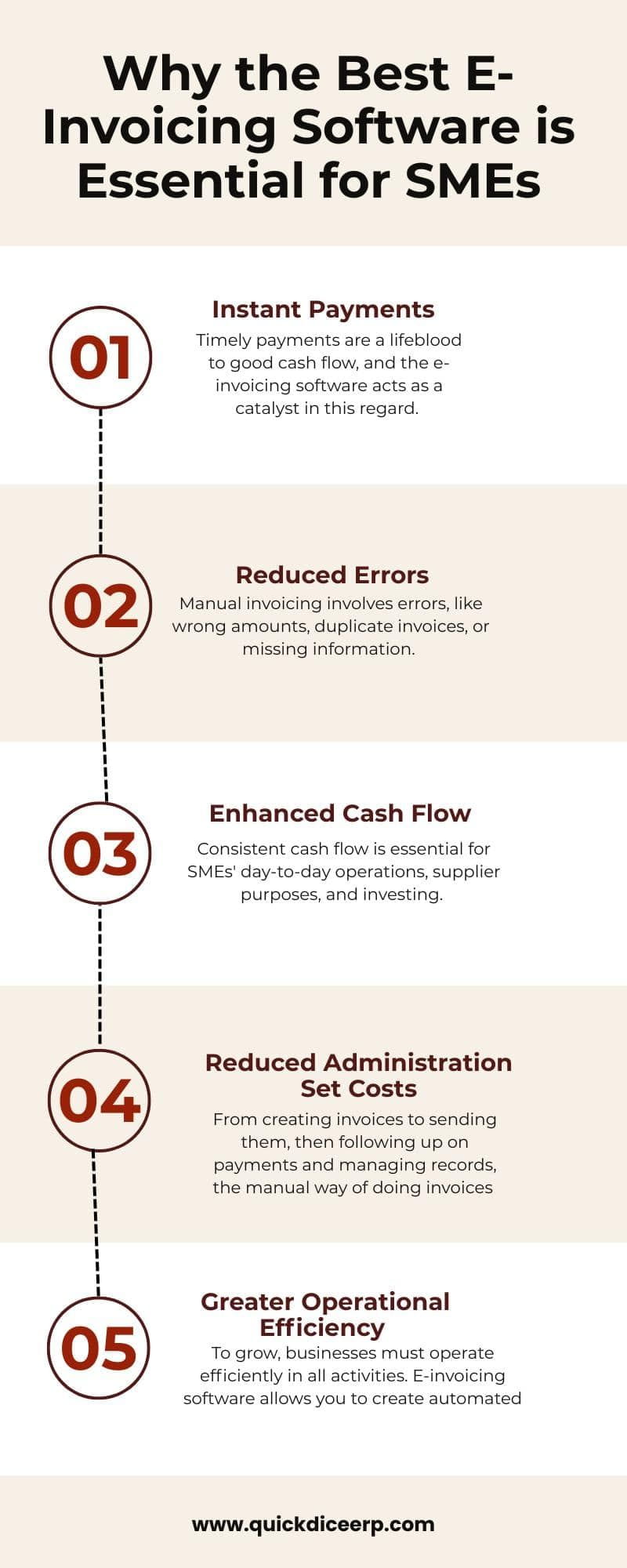

Here are some of Why the Best E-invoicing Software is Essential for SMEs.

Advantages of E-Invoicing Software

1. Instant Payments

Timely payments are a lifeblood to good cash flow, and the e-invoicing software acts as a catalyst in this regard. Delays are very common in traditional invoicing due to many manual processes, postal services, and follow-ups in case of late payments. But, with the advent of e-invoicing, businesses can send invoices as and when they are ready and set automatic reminders for customers in respect of their dues or slow pay on invoices. This said automation reduces the payment delay, thereby assisting businesses in obtaining funds more quickly, thus increasing financial stability.

2. Reduced Errors

Manual invoicing involves errors, like wrong amounts, duplicate invoices, or missing information. Such mistakes can cause disputes, which delay payments and necessitate administrative work to correct them. The automation of data entry and invoice generation causes e-invoicing software to prevent or minimize these errors. Most e-invoicing solutions integrate with accounting software and thus ensure calculation accuracy, tax compliance, and standardized invoice formats. This reduces the chances of manual errors and enhances financial accuracy.

3. Enhanced Cash Flow

Consistent cash flow is essential for SMEs' day-to-day operations, supplier purposes, and investing. The software system for e-invoices increases payment speed by bypassing delays inherent in traditional invoicing. Automated reminders act as a constant nudge for clients to pay on time, whereas digital invoices give businesses an upper hand in tracking outstanding payments. Many e-invoicing packages will even provide real-time analytics to help these SMEs monitor cash flow trends and make pertinent financial decisions.

4. Reduced Administration Set Costs

From creating invoices to sending them, then following up on payments and managing records, the manual way of doing invoices consumes much administrative effort. E-invoicing software eliminates the whole process through which invoices are created, printed, and mailed. As such invoices will not be paper-based, it will eliminate printing and postage costs. This allows businesses to keep invoices electronically, thereby eliminating loads of files and minimizing financial records being lost. Not only this; it also saves on costs spent on administration time that could be otherwise used in more productive activities for employees.

5. Greater Operational Efficiency

To grow, businesses must operate efficiently in all activities. E-invoicing software allows you to create automated processes that tie invoicing seamlessly to provisions within accounting, inventory, and customer relationship management systems. All these eliminate redundancies and improve efficiency across all levels of business operations as there is a smooth flow of information dovetailing from one function to another. In addition, these companies can do automatic invoice generation and recurring billing as well as multi-currency support, keeping their invoicing needs in black and white.

6. Enhanced Relationship

The most important assets any business has are suppliers and customers; therefore, the business must keep these healthy and thriving relations. E-invoicing is a software solution that will build trust and confidence as they relate to very transparent, clear, accurate, and timely invoices. Suppliers appreciate payments that are timely and accurate. This would create possibilities of better prices and priority services for the customer. Such an eating away would offer clear and simplified information about the payment facility to create a headache-free experience for consumers. In addition, it creates smooth cash transactions that open doors to the establishment of good relationships and goodwill for the business in the market.

7.Regulation Compliance

Many countries have now instituted a sliding scale of harsh regulations governing electronic invoicing. Businesses concerned must strictly conform to these standards as well as tax reporting requirements to be regarded as compliant. The best e-invoicing software therefore has been designed to avail itself exclusively to the consumption of SMEs, mostly to minimize chances of penalties and legal issues ensuing from such regulations. These specific features include taxation, digital signature and audit trails that ensure credible transactions since invoices now become compliant with revenues. Such an approach simplifies compliance as well building trust with tax authorities and financial institutions.

8. Eco-Friendly and Sustainable Approach

Becoming entirely paperless through e-invoicing mitigates the environmental footprint of an organization in terms of paper usage, printing waste, and postal waste. Businesses are becoming increasingly green, and e-invoicing has fit extremely well into their agenda for sustainability. For SMEs, lowering carbon footprints brings the benefit of showcasing an image of corporate responsibility, as well as savings in cost in transacting paperlessly.

Conclusion

Adoption of the world-class e-invoicing software is no longer a luxury but a necessity for SMEs that aspire to efficiency and success. It disposes the enterprise of paperwork, minimizes errors, and accelerates payments and the amalgamation thereof strengthens financial fortitude. Dealing with an increasing number of invoices manually becomes nigh impossible as the business grows. Automating payment chase or billing errors will enable companies to concentrate on their core operations.

Investing in the right e-invoicing software enhances compliance with ever-changing tax laws and minimizes the probability of legal complications. SMEs adopting this technology become empowered in customer relations and the assurance of steady cash flow, thereby gaining a competitive advantage. In the digital age, investing in a good e-invoicing platform is a strategic move that ensures the long-term prosperity of any business.

window.NREUM||(NREUM={});NREUM.info={"beacon":"bam.nr-data.net","licenseKey":"NRJS-3109bb2e2783f515265","applicationID":"558315209","transactionName":"blUHbEVQCxECBUVQWVcfMEpeHhARBhRCFlRVXwIXVEMAAxcDU1VZXh4VUEc=","queueTime":0,"applicationTime":154,"atts":"QhIEGg1KGB8=","errorBeacon":"bam.nr-data.net","agent":""}

Written By:

Aya Basha

Hotels at your convenience

Now choose your stay according to your preference. From finding a place for your dream destination or a mere weekend getaway to business accommodations or brief stay, we have got you covered. Explore hotels as per your mood.